Owning a home can be a great opportunity to build wealth over time. Yet, the reality of property taxes can put a damper on your annual cash flow. However, there may be a way to make adjustments to your expenses: By requesting a reappraisal of the value of your home, you might just find yourself on the path to reducing your property taxes. It’s all about ensuring that the assessed value of your home aligns with its current market value. And guess what? The current market dynamics in Berkeley might just be in your favor. Let’s delve into how you can make this work.

Acquainting with the Current Assessment

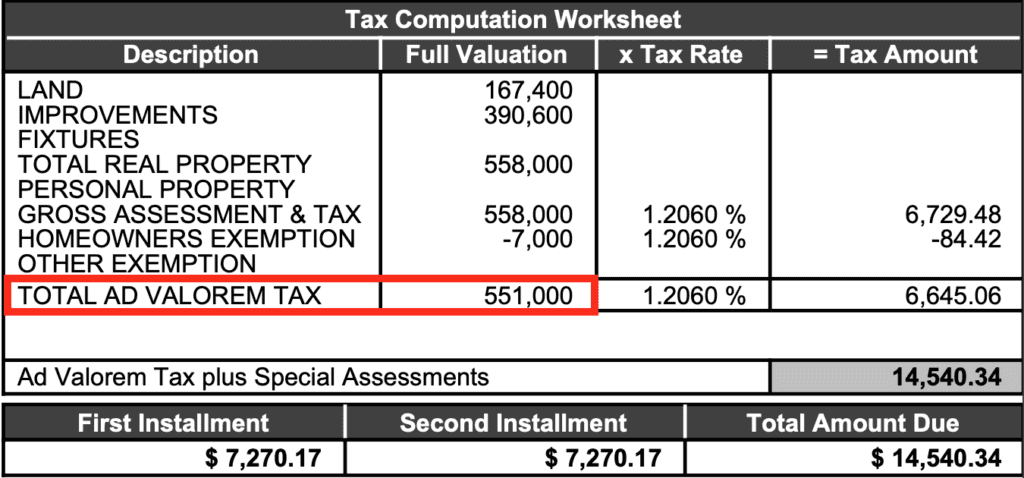

It’s crucial to understand where you currently stand with your property assessment. Grab a copy of your latest property tax assessment from the Alameda County Assessor’s Office. You’ll want to click the Secured Property Tax button. You then enter your address or parcel number, click the ‘view bill’ button under the Current Year Tax Information section. and then download a pdf of your most recent statement. Note that your property value is divided into two parts: Land and Improvements. You are looking for the Full Valuation on the Total Ad Valorem Tax line as in the image below:

This will be your starting point. Now, how do you figure out if your home is over-assessed? A good place to start is by scoping out recent sales of properties similar to yours in your neighborhood. If homes are selling for less than your home’s assessed value, you might have a solid case. If you want more information on how property taxes work, take a look at my article, Property Taxes Explained.

The Quest for Comparable Sales

Now, it’s time to scout the terrain. Dive into the local real estate market to unearth recent sales of properties that resemble yours in size, condition, and location. The golden nugget you’re digging for is evidence of comparable homes selling for less than your home’s assessed value. A lower market value in your neighborhood could be your first clue that your home might be over-assessed. Of course you can use public real estate aggregation sites such as Zillow or Redfin to do this research, but you’re better off working with an exceptional, local real estate agent. Your agent will have access to tools that make developing a comparative market analysis (CMA) easier and provide you with a more accurate sense of the value of similar properties in your neighborhood.

Recruiting a Professional Appraiser

Now, here’s where things get a bit more official. Hiring a professional appraiser to get an updated value of your home could be a game changer. Sure, it’s an extra expense, but having a professional appraisal in your arsenal could significantly bolster your case for a lower assessment. Home appraisals can cost from several hundred dollars to a thousand dollars or more depending on your location, the size of your home, and the experience of the appraiser.

Most professional appraisers will use 3 different models to come to an assessment of the value of your home. These are typically:

- Sales Comparison Model: This is like a CMA where similar nearby homes that were sold recently are used as a value reference

- Replacement Model: This is an estimate of what it would cost to build your home from scratch.

- Income Capitalization Model: This approach uses an estimate of the income potential of your home if you were to rent it. The future cashflows are then divided by an expected rate of return to come up with an approximate valuation.

Having a professional appraisal report will put you in position to lobby the county of Alameda for a valuation adjustment if you determine that your property tax base is overvalued compared with current home property values.

Crafting Your Reassessment Request

Once you’ve gathered your evidence, it’s time to make it official. Craft a well-argued letter requesting a reassessment of your property value, and collect all the supporting documents like your new appraisal and data on comparable sales. You will then go to the Alameda County Assessor’s Office website and either submit your request online or download the PDF form and mail it back to the county. You will need your assessor’s parcel number (APN) which you can find on the county website – choose the property address search option, type your address, and you’ll see the APN in the resulting serach results. Remember to strictly adhere to their guidelines and deadlines to ensure your request is processed smoothly.

If at first you don’t succeed, don’t fret. If your request for a reassessment is denied, you have the option to appeal the decision, which could involve attending a hearing. You can find out more information on the appeals process and access any required forms on the County of Alameda website. It’s your opportunity to present your case, backed by all the evidence you’ve gathered. Stay calm, composed, and articulate your arguments clearly.

Enlisting Legal Assistance

The road to a successful reassessment can sometimes get a bit winding. If things start to look complex, or if your appeal goes up a few rungs on the legal ladder, it might be wise to bring a tax attorney on board. They are pros in navigating the legal maze of property tax appeals. While it can be expensive to get legal representation, the amount you save in property taxes over a number of years is likely to outweigh the cost. If you need a recommendation for a qualified real estate or tax attorney, I have a number of professionals I can suggest. Just reach out to discuss your circumstances and I’ll point you in the right direction.

Staying the Informed Course

There are a number of things you can do to increase the odds of getting an appraisal adjustment to decrease your property taxes. Throughout this journey, keep yourself informed about any changes in local laws or procedures concerning property tax assessments and appeals in Berkeley or Alameda County. Knowledge is power, and staying informed will keep you ahead of the curve.

Also, maintain a meticulous log of all communications, submissions, and outcomes related to your reassessment request and appeal process. Should your case escalate to higher levels of appeal, this log will serve as a crucial reference.

Finally, keep a close eye on the real estate market and your property tax assessment, particularly if there are significant market changes. Staying proactive and seizing the opportunity for a reassessment when the time is right could lead to more savings down the line. Don’t hesitate to lean on me for assistance on the state of the market.

Conclusion

Embarking on a property reappraisal journey requires a mix of thorough research, professional support, and a dash of persistence. But the potential to lower your property taxes could make this venture well worth the effort. Including all special assessments and supplementary taxes, the effective property tax rate in Berkeley is nearly 1.7%! That means that for every $100,000 reduction in appraised value you save $1,700 annually on property taxes. So, if you’re eyeing some financial ease, a home reappraisal might just be your ticket!