My October 2022 real estate market update begins with the news that the September consumer price index (CPI) report which came out last week showed higher than expected increases, despite actions taken by the Federal Reserve to combat inflation.

Here are a few highlights from the report:

- Overall inflation increased by 0.4% which was twice the amount expected by analysts.

- Year-over-year inflation (YoY) declined modestly from 8.3% to 8.2%, but less than expected.

- The core inflation rate, which excludes food and energy, increased by 0.6% to 6.6%.

- Shelter expenses rose by 0.7% which is the highest increase since 1991.

- Rents are up more than 7% YoY, though it appears we have reached a peak and are seeing slight rent cost declines over the past couple of weeks

As for real estate, here are some key findings:

- Median list prices have grown 13% over the prior year

- New listings are down 15% from last year

- Active inventory is up more than 30% from 2021

- Days on market are up 7 days from last year

While the Fed Rate increase of 75 bps during their September meeting is not reflected in the most recent CPI report, rate increases from July and earlier are factored into the CPI. This means the increase in rates has not been as effective in stifling inflation as Federal Reserve board members were hoping.

Because inflation has yet to start to decline, economic analysts are forecasting that the Federal reserve will increase rates by 75 bps in their November 2nd meeting and another 50 bps at the December 14th meeting.

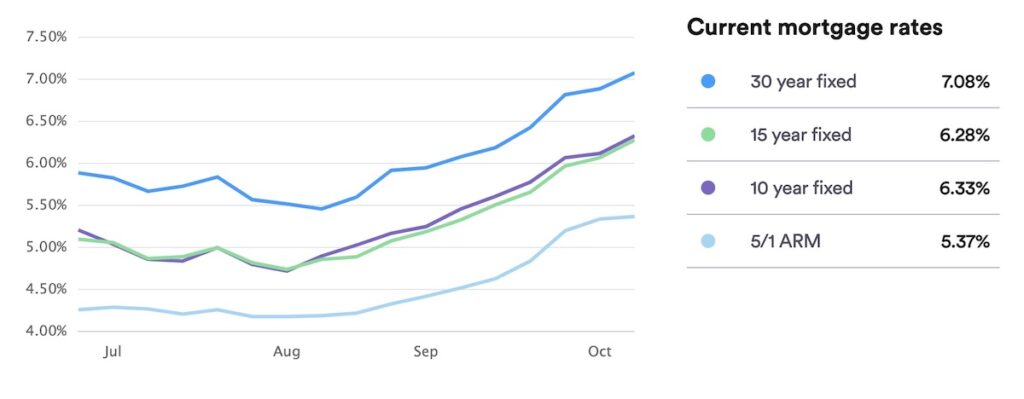

This implies we are likely to continue to see mortgage rate increases through the remainder of the year. So, what does this mean for the local real estate market? Well, it’s a mixed bag. Inventory remains low, but with homes sitting on the market for longer periods of time we are seeing those numbers climb. Buyers continue to wait for deals, but higher interest rates are likely into 2023. Here is a chart of mortgage rates as of October 8th.

This is what I’m advising my clients:

Sellers

- Inventory is gradually increasing which will mean more homes on the market to compete for a limited pool of buyers.

- We’re gradually moving from a seller’s market to a buyer’s market which is likely to mean lower home values in the months ahead, along with higher mortgage interest rates.

- If you are contemplating selling in the next 24 months, sooner is better than later. You will likely get more money for your property

- Assuming you’re going to repurchase after your sale, mortgage rates are likely to go up so you will save money by repurchasing sooner.

Buyers

- When the Fed finally signals an end to rate increases, pent-up buyer demand will flood the market. If you wait until next spring, there will almost certainly be more buyers to compete against. Buying now ensures you have little competition and can negotiate a good price.

- Everyone must live somewhere. You either rent, or you buy. I chose to buy, and I’m glad I did. So did your landlord, and I’m sure they’re glad they did. And I’m sure they’ll be even more glad if you don’t! The focus should be the next 5-10 years, not 5-10 months.

- Sellers who are listing their properties in the next several months are serious and want/need to sell. Buyers who want to purchase but are concerned about rates have an opportunity to negotiate.

- The time to buy is when no one else is. Historically speaking, People who bought in economic downturns like 2008-2010; 2001; 1994-1996 purchased at lower prices and had higher appreciation than those 3 years after that period.

- Interest rates ARE rising but renting is 100% interest… As a buyer, you’re stepping into the driver’s seat in the housing market for the first time in a long time. While rents and mortgage rates are up now during this inflation surge, rents continue rising regardless, usually around 2-3% a year.

If you want to learn more, please reach out to me for an individualized consultation. I can help you analyze your personal situation to determine what role real estate might play in your financial future. Also, if you know anyone looking to buy or sell a property in Berkeley, do them a favor and send them my way!