The U.S. macro economy remains surprisingly resilient. However, there are significant long-term global headwinds that have bond investors betting against U.S. treasuries. What does any of this mean for what the Federal reserve will do next and how will these factors impact mortgage interest rates and the larger real estate market? Read on to get my take on these many confounding factors.

Current Market Conditions

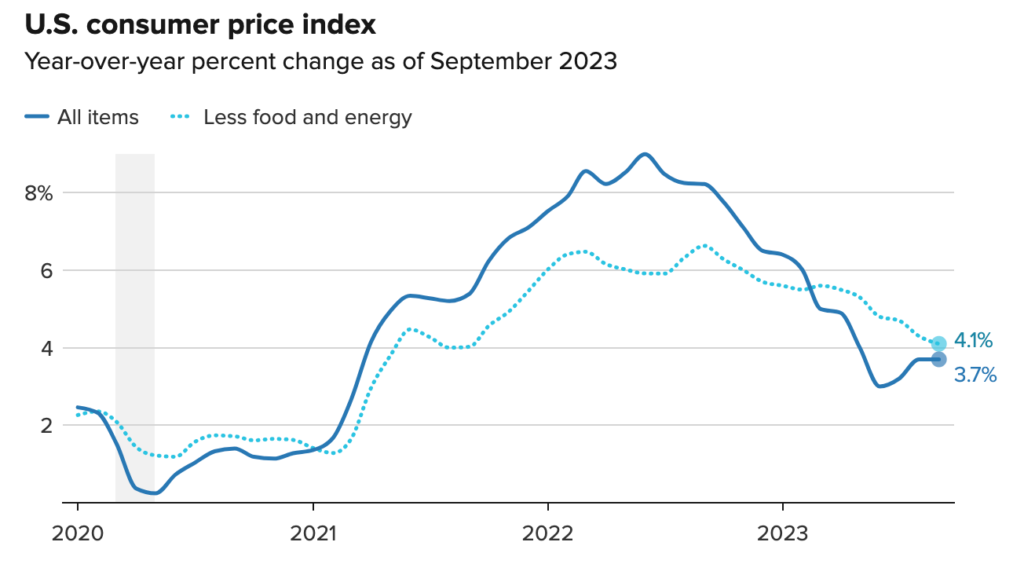

The September Consumer Price Index report came out a couple of weeks ago and showed that inflation had increased slightly more than analyst expectations. However the core price index, up 4.1% from the prior year, was in line with expectations. Remember that the Federal Reserve Board is targeting a long-run, stabilized inflation rate of just 2%, so there is still some work to be done before the economy settles at that modest yet sustainable level of price growth.

As we’ve seen in recent months, a major component of the core index increase is from the shelter category which includes rents and rent equivalents and accounts for more than 1/3 of the entire index. It’s notable that shelter costs have increased a whopping 7.2% from the prior September.

We also saw a relatively upbeat September jobs report earlier this month with unemployment holding at 3.8% and the economy adding a reported 336,000 new jobs, well above the expected 170,000 new jobs. While some analysts believe that this report of job creation is an anomaly and partly due to seasonal factors (i.e. teachers entering the workforce for the school years), it remains a substantial decrease from the prior year when 423,000 new jobs were added.

The initial response from the Fed to the strong CPI and jobs report was to imply that rates may need to remain “higher for longer” in order to combat stubborn inflation. This was not interpreted as a sign that the Fed would raise rates again at its November meeting, but instead that it was more likely to hold the currently high levels for a longer period of time. This expectation has not helped reduce mortgage rates which peaked near 8% last week.

Macro Conditions Influencing Long-Term Interest Rates

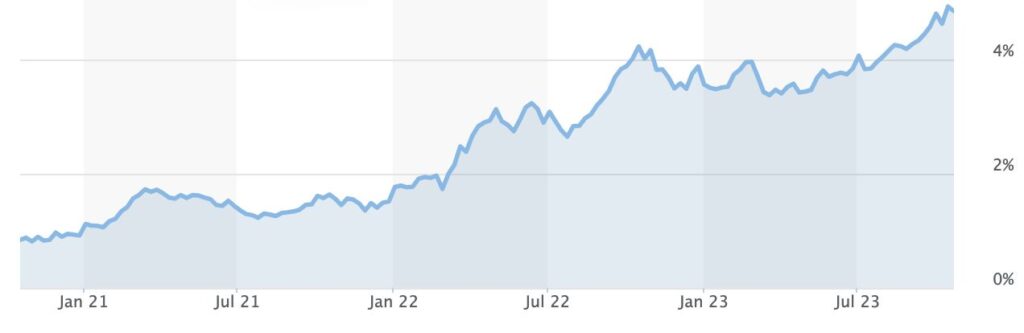

In times of geopolitical strife, investors tend to flock to treasury bonds as safe bets, driving down the interest rates paid on those bonds (when demand for bonds is high, issuers can offer lower rates of return). However, that isn’t the case in the current environment. The yield on 10 year treasury bonds rose past 5% yesterday, the highest level they’ve been since 2007.

It appears that bond investors are concerned with long term U.S. fiscal deficits from borrowing to fund, in part, allies in Israel and Ukraine. More Federal debt financing will require that the U.S. to offer higher yields to attract new investors which will increase debt servicing costs. These forecasts, along with oil supply reductions and associated energy cost increases, are just a few of the structural factors contributing to elevated interest rates. These are all independent of what the Fed does with the short-term Prime rate.

It appears we may be entering an extended period of higher interest rates.

What This Means For Real Estate

The trend in escalating shelter costs seen in the September CPI report is partly due to high mortgage interest rates and limited housing inventory. There is little new home construction happening due to the high cost of borrowing, which continues to constrain housing supply, keeping prices elevated. Also, in the Berkeley real estate market and the surrounding area, there are few places for new construction to take place.

Since high mortgage rates are making home ownership unaffordable for many first time home buyers, more people are renting, driving up rental costs.

If you do happen to own a home that was refinanced when interest rates were low, you’re sitting pretty. Your mortgage payments are relatively modest, and with wage growth, you may be feeling a bit more comfortable than you were a few years ago.

While there are a limited number of buyers in the market right now, given the extremely tight inventory homes in desirable neighborhoods that are in good condition are continuing to command a substantial premium. If your property fits this description, selling now may be a good idea. Once mortgage rates come down, many buyers will reenter the market which will also lead to more sellers and thus more competition.

Finally, the silver lining of longer-term high interest rates may be that the Fed will see fit to lower the short-term Fed rate sooner rather than later. This will not happen in 2013, but depending on what happens with the economy over the next few months, we may hear signals from the Fed that monetary loosening will be on the table in the spring. As soon as markets get a forecast of future rate reductions, we tend to see long term bond and mortgage rates begin to decline.

Conclusion

We are in a period of considerable uncertainty and contrast. Some indicators are showing a healthy, growing economy, while others indicate there are storm clouds on the horizon. These times are useful as a reminder that we cannot predict or time the market. There are far too many global factors that influence interest rates and housing prices to reliably forecast the future. Our best bet is to live our lives, make the moves we need to given our current circumstances, and make sure to get help from experts when it’s time for a change.

I find it fascinating to study the economy and how it impacts my clients, and I’m always happy to chat about the details and how I think these trends may impact your personal situation. Please contact me if you have any questions or just want to chat, and I’ll continue to provide regular market updates. So until next month, stay safe and don’t take any of this stuff too seriously.