Thanksgiving is upon us and there appears to be a lot to be thankful for. Recent economic reports indicate that the Fed has been mostly successful in their fight against inflation, and markets have responded accordingly. We have seen both stock market rallies and a considerable drop in ten-year treasury bond yields which have translated into lower mortgage interest rates. Mortgage applications are up and most indicators are showing a healthy and stable economic environment. What does all of this mean for the local real estate market in the weeks and months ahead? Time for my November real estate market update to find out.

Current Market Conditions

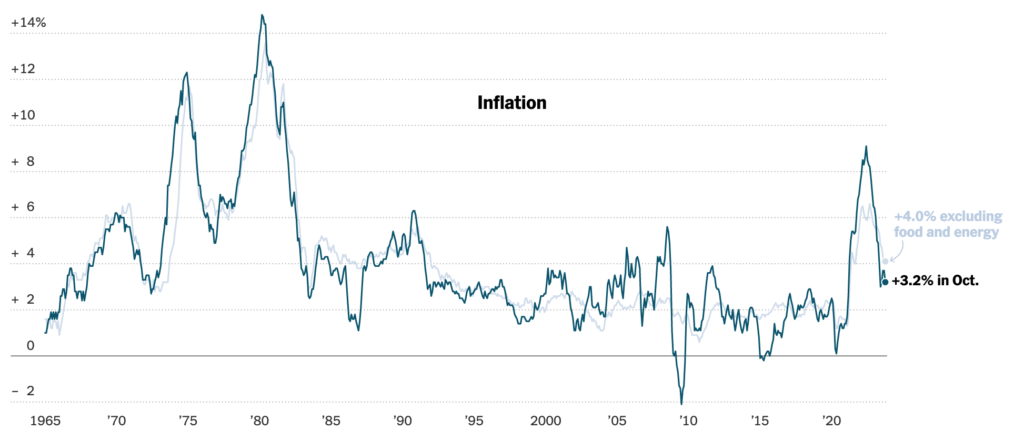

Per usual, let’s start with the October consumer price index report. Year-over-year, the CPI slowed to 3.2%, down from 3.7% the previous month. Both gas and housing prices were down sharply and the inflation number exceeded analysts expectations, which is usually a positive sign for markets looking for clues on future Fed moves. When we look at the core index (excluding food and energy prices), the inflation rate was just under 4%, slightly lower than the 4.1% increase in September.

It’s worth keeping in mind that the Federal Reserve Board inflation target is just 2%, so we still have a bit more work to do before we can really celebrate. That said, the October data is trending in the right direction, indicating that the Federal reserve may be at the end of its ‘tightening’ spree.

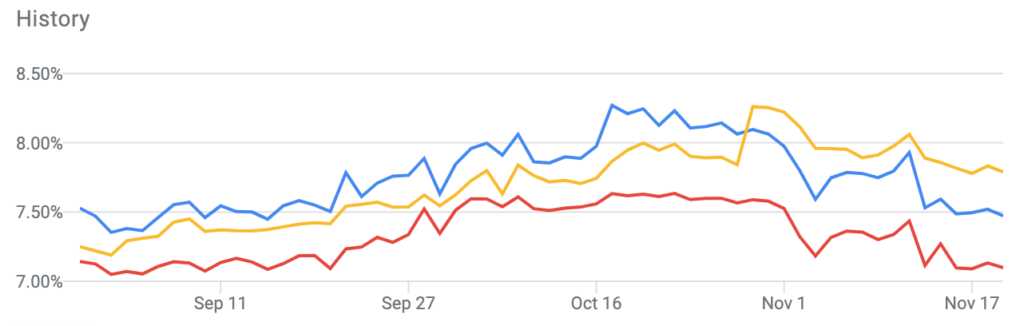

Markets responded favorably to the inflation news with the Dow Jones index climbing 500 points while treasury yields dropped. This reflects market expectations that we have seen the end of Prime rate increases. Mortgage interest rates are closely tied to the 10-year treasury bond yield and the average mortgage rate dropped to 7.69% from 7.74% just a week ago.

Note that these are averages and 30-year fixed mortgages can now be found for as low as 7.125% for conforming loans if your credit score is above 750.

Things To Be Grateful For

The fact that inflation appears to be under control and mortgage rates are coming down are not the only things to be grateful for. The rest of the U.S. economy is showing signs of strength which gives me cause to celebrate in this time of gratitude.

- Growing Labor Force Participation: The job market has seen a remarkable influx of workers, particularly among those aged 25-54, where the employment rate reached 80.6% in October. This figure is significantly higher than most months since June 2001. Notably, the labor force participation of women aged 25-54 is approaching record levels, dispelling fears of a long-term pandemic-induced downturn in female employment.

- Increasing Real Wages: Adjusted for inflation, wages are on the rise. Although wage growth has decelerated from its rapid pace in 2022, it is now outstripping inflation, reversing a period when real wages effectively decreased. Over the past year, the average hourly earnings for regular workers increased by 4.4%, compared to an inflation rate of 3.2%. This improvement in real wages is bolstering consumer spending, a key component of the U.S. economy.

- Boost in Productivity: There is a notable increase in productivity, with Americans producing more per hour worked. This could be a temporary statistical fluctuation, but it might also indicate deeper positive changes in the economy, such as the easing of pandemic-related supply issues, effective integration and training of new workers, and potential gains from artificial intelligence advancements. This productivity growth could enable the economy to expand while keeping inflation and recession risks at bay.

- No Banking Crisis?: Following the collapse of Silicon Valley Bank and two other large regional banks, there have been no further major bank failures, and credit availability has remained stable. The government’s intervention to protect all SVB depositors, including the largest ones, effectively bolstered confidence in the banking system, preventing mass deposit outflows and significant lending contractions.

In short, the economy is humming along and it appears that the Fed may have engineered the hoped for “soft landing“.

What This Means For Real Estate

As we move into the slow holiday season and the demand for home purchases decline it is relatively common to see mortgage interest rates drop a bit in order to encourage buyers. Even if we do see the economy dip into recession in 2024, that could, ironically, be a positive thing for the housing market.

While the Fed has been pushing a narrative of “higher for longer” in order to keep market expectations in check regarding future interest rate cuts, a slow down in economic activity and an increase in the unemployment rate could spur rate cuts sooner rather than later.

This would be a boon to the real estate market as it would make mortgage loans more affordable to buyers, thus increasing their purchasing power. Simultaneously, lower mortgage rates would also encourage sellers to get off the sidelines and list their homes for sale. May prospective sellers have felt ‘locked in’ by very low refinance rates, and a mortgage interest rate decline would give them greater comfort when repurchasing after a lucrative sale.

Conclusion

It appears that the worst of inflation and high mortgage interest rates are behind us and the economy appears healthy. These are clearly things to be thankful for on during a period of global unrest. Of course things could change quickly, but the likelihood that we see a return to rising inflation rates is looking vanishingly slim.

Of course it is never a bad time to make long-term investments in real estate, regardless of short-term interest rates. Future refinancing is always an option and the historic appreciation of property in desirable markets (like the Bay Area real estate market) appears poised to continue for the foreseeable future. I’m always available to provide you with a personalized consultation if you have any questions or just want to chat, and I’ll continue to provide regular market updates. So until next month, enjoy time with your family, celebrate the holidays, take some time to rest, and remain grateful for the things in life that are truly important.