This spring has been quite interesting from a Bay Area real estate perspective. We’ve seen a healthy increase in homes for sale after a couple of years of very tight inventory. However, even with pent-up buyer demand, comparatively high interest rates have meant many homes sitting on the market for longer than normal and selling at more modest prices.

Once again we saw the Federal Reserve hold rates steady at their most recent policy meeting. They have not seen enough data to support the notion that inflation is moving toward their target of 2%. Consequently the Fed continues to signal ‘higher for longer’ when it comes to rates.

Given recent data, some economic observers are wondering if there are other dynamics at play that is leading to ongoing economic growth and a strong job market in face of persistently high rates. Let’s take a closer look at the details, and consider how these dynamics may impact the local real estate market as we enter the summer season.

Current Market Conditions

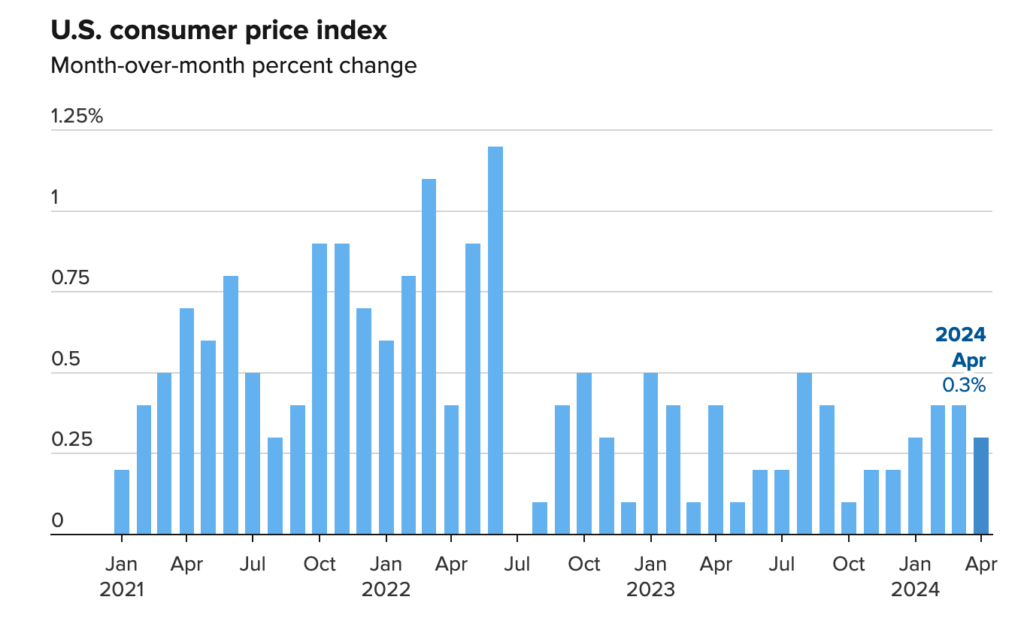

To start with, the April Consumer Price Index report showed slight cooling compared to the March data, which was a welcome relief. Consumer prices climbed 3.4% compared with the prior year, down from 3.5% the month before. While this is still a ways off from the Fed target of 2%, the numbers resumed declining after several months of increases. Core inflation, excluding volatile food and energy expenses, was down from 3.8% in March to 3.6% this past month. Since more than 30% of the core index is composed of ‘shelter’ costs, this implies a modest cooling of real estate prices.

To further support the idea that the economy is slowly cooling, a retail price report last week showed no change from the prior month.

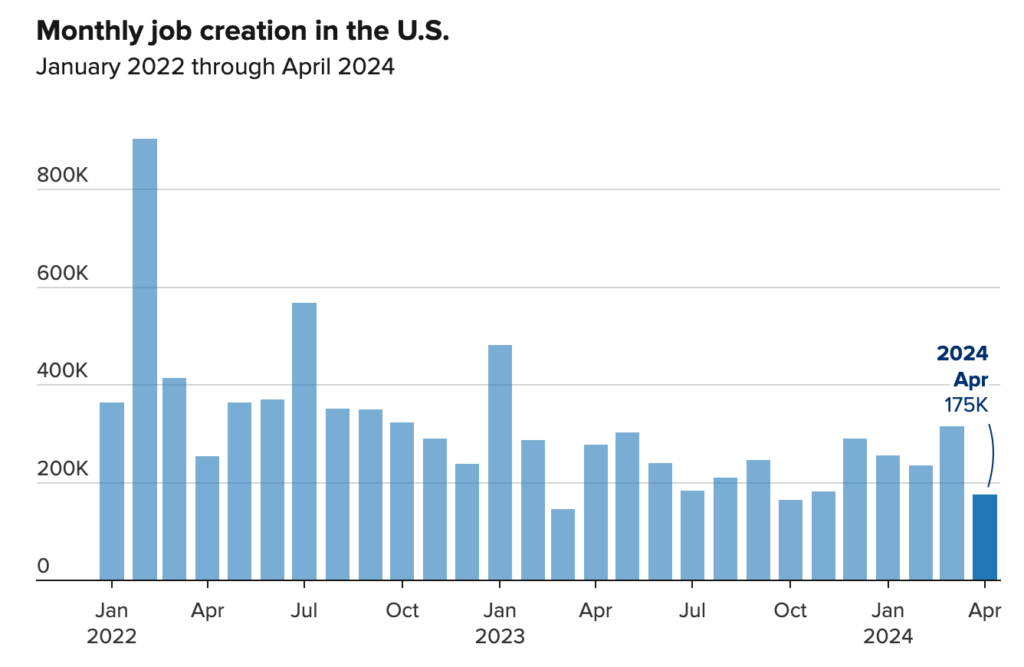

Finally, the April jobs report came in much lower than expected. Analysts were anticipating up to 240,000 new jobs, but the report showed just 175,000, along with a slight increase in the unemployment rate to 3.9%, the highest level we’ve seen since November of 2021.

While all this data implies that inflation is abating, the Fed has yet to see sufficient evidence to commit to interest rate cuts at the next policy meeting on June 11-12. In fact, minutes from the May meeting showed a willingness by some reserve board members to tighten policy even further if economic circumstances warrant.

What It Means

The fact that the U.S. economy has remained so strong in the face of sustained high interest rates has been a puzzle for economists. Classical economic theory forecasts that when borrowing costs go up, economic output comes down. Higher interest rates typically reduce capital available for investment which leads to a reduction in output, fewer jobs, and slower economic growth.

Yet what we’ve seen since the Fed began raising interest rates in March of 2022 is counter to the expectations of economic theory. While inflation has been brought down significantly during this period, economic and job growth has remained surprisingly strong.

One possible explanation for this that is being explored by economists is a dramatic increase in overall economic productivity. In the first quarter of 2024 U.S. economic output was up 3.2% from the prior year. Yet the number of hours worked by the average American only increased by 0.3%. This means that labor productivity increased by 2.9% over this period.

Productivity is defined as the ratio of output to input, or the resources required to produce it. This means that workers are, on average, producing considerably more output with just slightly more effort. While this is just a single data point, it’s notable that average productivity gains during the 2010’s were just 1.3%.

If our economy is producing more goods and services using effectively the same labor inputs, it’s unsurprising we have seen ongoing GDP growth and relative price stability, even in the face of higher borrowing costs.

Also notable is the fact that other western democracies are not seeing similiar productivity gains, leading to the conclusion that the strong economy we find ourselves in is not due to global supply chains or trade imbalances, but is unique to the the United States.

The Impact On Real Estate

So down to brass tacks. What does all this have to do with the real estate market? In my humble estimation it means simply that mortgage interest rate reductions are off the table for the time being. I’m not suggesting that productivity gains continue indefinitely or to anticipate a perpetual regime of higher interest rates. Yet the optimism that emerged from declines in inflation in late 2023 have effectively evaporated in the first half of 2024.

While we’ve seen increased housing inventory this spring in Berkeley and the surrounding inner east bay, buyers have remained hesitant. This is particular true for properties that aren’t in great walkable locations or require substantial improvements.

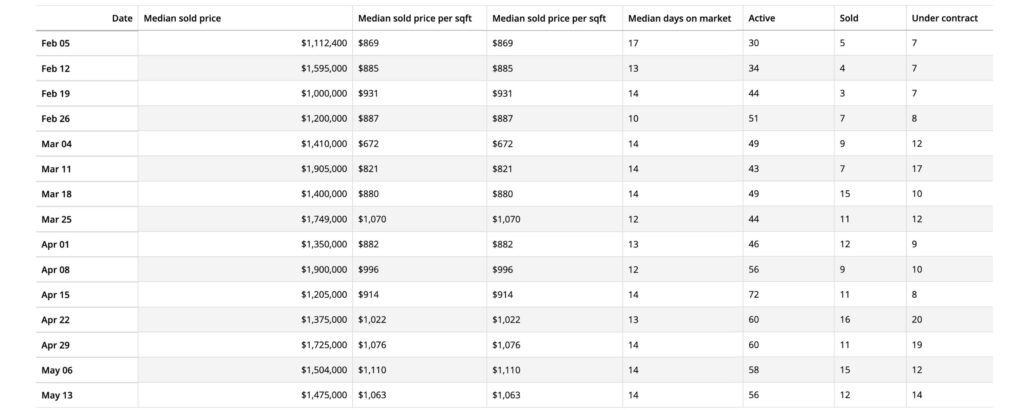

Recent data from the Berkeley market illustrates these dynamics. Active listings grew steadily from early February, peaking in late April. Sales prices also followed this trend, though we’ve seen a regression over the past few weeks: More properties on the market, relatively fewer sales, and a slight decline in home values.

This implies that buyers are losing confidence that rate reductions are going to be forthcoming. Buyers are holding off on purchases for the time being due to high borrowing costs.

Conclusion

This, of course, is all speculation on my part. Housing market forecasts are notoriously unreliable and I’m not entirely convinced that my explanations for what we are seeing in real estate right now are even accurate. That said, the reality remains that rates are high and demand is somewhat stagnant.

So, for those of you wondering what to make of all this, my recommendations remain the same:

- You can’t time the market. Don’t try.

- Real estate is a great long-term wealth building investment. Over 5-7 years you will likely beat the stock market in terms of returns. Just make sure you have a long enough time horizon so you aren’t forced to sell in a down market.

- Let life circumstances and the dynamics of your individual family situation dictate when you buy and sell property.

You don’t have that much control over many of the factors that impact home purchase volume and sales prices. There is little reason to stress about things you can’t influence. So take all of these changes in stride, and when you’re ready, contact me to determine the best path forward. I can help guide you through the various decision branches and advise on where the risks and opportunities lie. Together we can chart a path forward to meet your goals with the least amount of effort and heartburn.