It’s now time for my May 2023 real estate market update. We’re already seen the Federal Reserve meeting results as well as the April Consumer Price Index report. These reports give us some useful information in forecasting the real estate market, but there are other uncertain factors which continue to make the future cloudy. The most impactful of these is the looming Federal debt limit fight coming in the weeks ahead which could be a huge swing in either direction for economic stability.

There are also a number of global structural challenges related to inflation that are well beyond the control of U.S. monetary policy. It’s worth taking a moment to consider some of these factors and think about how they may play out in the real estate sector in the coming months and years.

Current Market Conditions

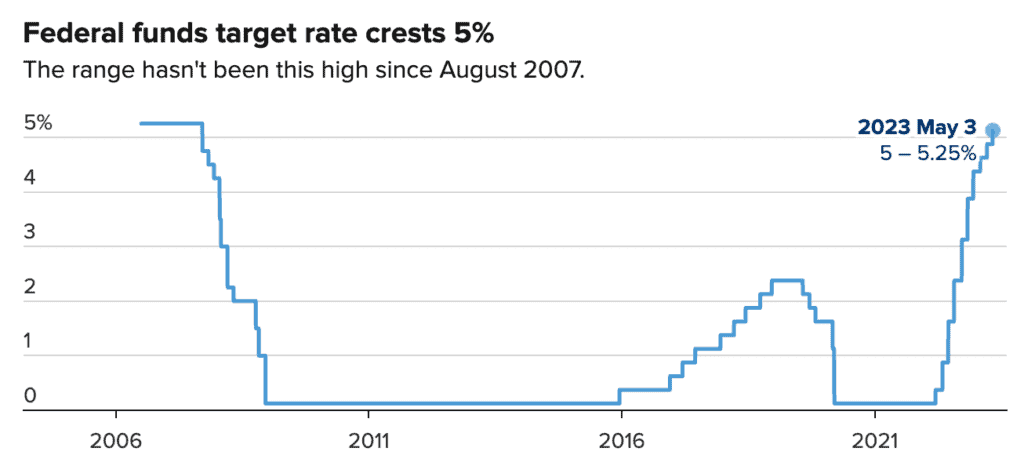

Following the Federal Reserve’s governor’s board meeting on May 2-3, the Open Market Committee approved it’s 10th interest rate increase in a little over a year, raising the Federal Funds rate by another 0.25%. This brings the Federal Funds rate to just over 5%, the highest it’s been since August of 2007.

While this rate increase was broadly anticipated, the question that remains is whether the Fed is at the end of this cycle of rate hikes. There were some indications in language released following the rate hike announcement that there may be a pause in future increases, but further inflationary data will be needed before the Fed can make a final decision.

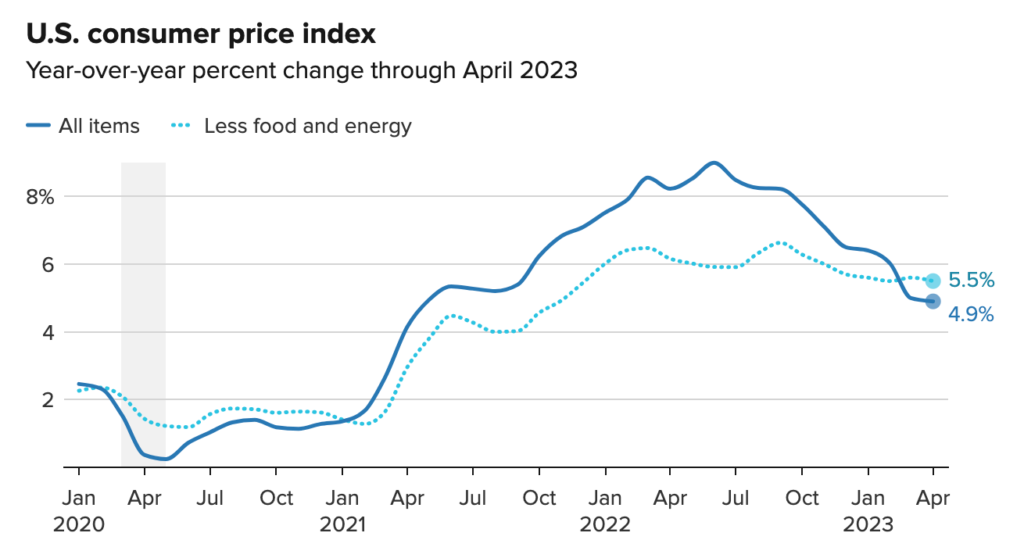

To that point, the April Consumer Price Index report was released on Wednesday, May 10th. On an annualized basis, the report should slightly lower inflation than analysts forecasts, providing further support for a freeze on future rate hikes. The year-over-year change in the CPI is now at 4.9%, down from last summer’s peak of 9%, but still quite a ways off from the Federal Reserve’s target of 2%.

Why It Matters

While we have seen a steady decrease in consumer prices over the past year, there is only so much that monetary policy can do to address inflation. Some consumer goods respond relatively quickly to monetary policy signals, particularly goods with more elastic demand. Other products and services respond more slowly to interest rates adjustments and thus there is “low-hanging fruit” when it comes to fighting inflation. Effectively, each incremental reduction in the inflation rate becomes increasingly more difficult and takes longer to achieve than the prior one.

Part of this is due to the levels of demand for particular items (i.e. automobile leases vs. public transportation) and partly due to global structural issues that impact prices. There are three important categories of structural influence on prices that are worth considering:

- Labor: When the economy is at full employment and workers are receiving relatively high wages, spending power is increased and the demand for products and services remains elevated. Demographic trends in the U.S. are exacerbating this problem as more Boomers retire and there aren’t enough younger workers to replace them. Also, when thinking about the international market for goods, as countries like China increase their economic prosperity, wages of Chinese workers increase which leads to higher prices for goods imported from China.

- Technology: For the past few decades, technological innovation has been a deflationary factor as new inventions improve the efficiency of production processes. Increasing trends toward regulation and data localization are increasing the costs of technology adoption, thus driving costs up gradually.

- Trade: The supply chain challenges we saw during the pandemic have led corporate leaders to build more redundant and resilient sourcing operations, thus increasing the costs of goods and services. Also, international protectionist political trends are countering globalism and leading toward more insular relationships with friendly countries, thus increasing production costs.

What This Means For Real Estate

Over the next three to six months I expect to see a modest reduction of mortgage interest rates. This will free up inventory as seller’s become more willing to give up their low, refinanced rates of the past few years when looking to relocate. This will also help buyer’s as borrowing costs decrease along with property prices. The general consensus among industry watchers is that we’ll see mortgage interest rates gradually decline throughout the remainder of the year before settling somewhere between 5% and 6%.

Some pundits suggest that 5.5% is the threshold that will trigger a wave of home listings and unlock the market to buyers.

And One More Thing…

And that brings us back to the elephant in the room. The Federal debt ceiling. Since we typically run our economy in a deficit, we need to borrow money in order to pay our bills and service our federal debt. In order to borrow money, congress needs to approve the ability for the government to issue bonds. If the government can’t come to an agreement on the budget and doesn’t pass a resolution to increase the debt borrowing limit, we will begin to default on our financial obligations.

Apparently know one knows exactly when this will happen, but it apparently could start as soon as early June. This means not paying things such as social security benefits, federal salaries, medicare providers, and importantly, our creditors. The inability of the government to reach a deal to raise the debt ceiling would wreck havoc with the housing market among many other areas of the economy.

We have faced these types of negotiations in the past and the congress has never failed to come to a last second agreement, or at least a compromise to extend the debt limit for a short period while negotiations continue. If history is any guide, we’re likely to avoid disaster once again, but the closer we get to the default date, the more nervous markets become and the greater likelihood we encounter global economic consequences.

I’m betting a resolution is reached in the next few weeks and we go back to business as usual, but I could be wrong.

Conclusion

Another topic that I didn’t broach is the potential cascade of defaults in the commercial real estate sector, but I’ll leave that discussion for next month. In the meantime, most people will be best served by keeping your head down, saving for a down payment, thinking about where you want to be for the next 5-10 years, and be prepared to move quickly when real estate opportunities present themselves.

Regardless of where you are in your real estate journey, I’ll continue to provide regular market updates, and don’t hesitate to reach out if I can answer any questions for you or your friends and family. Till next month!