As we move into the heart of the summer season it’s time for my June 2025 real estate market update. I review what happened in the past month and how it may impact real estate activity in June and beyond. The East Bay housing market is being shaped by a mix of cautious optimism and persistent economic headwinds. The latest inflation and employment data offer a nuanced picture, and while the Federal Reserve is inching toward eventual rate cuts, buyers and sellers remain in a holding pattern.

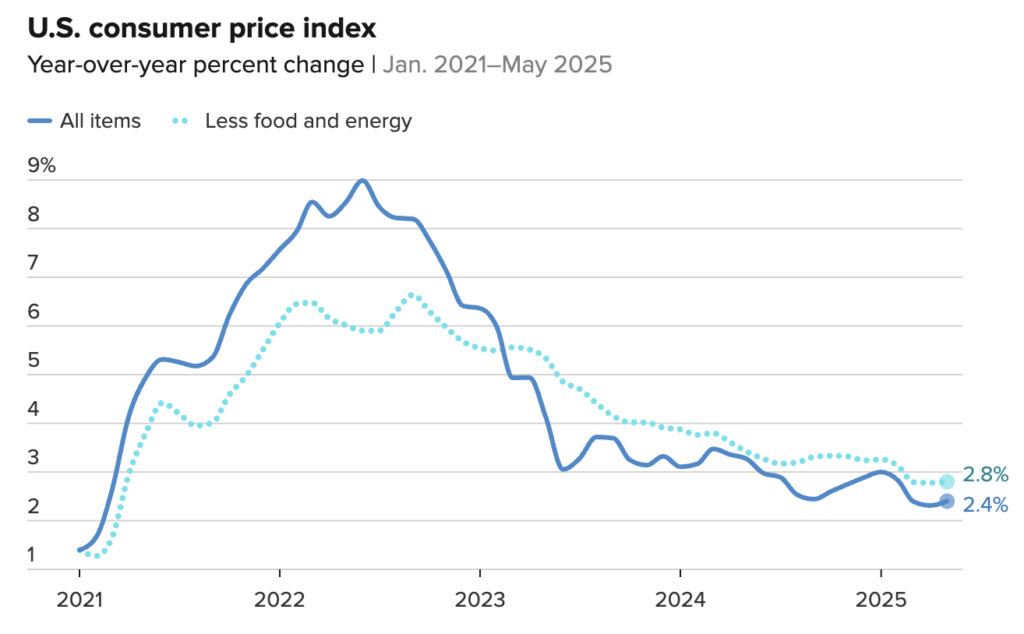

Inflation Cools – But Is It Enough?

The May Consumer Price Index (CPI) rose just 0.1% month-over-month, bringing the annual inflation rate to 2.4%, up slightly from April. More encouraging was the core CPI (which strips out food and energy), which also rose only 0.1%, well below expectations. This is the slowest core inflation reading in over three years.

That said, shelter costs—which include rent and owners’ equivalent rent—remain sticky, up 3.9% over the past year. As I’ve discussed in past articles, shelter makes up more than a third of the CPI weighting, so this implies ongoing price pressure for housing.

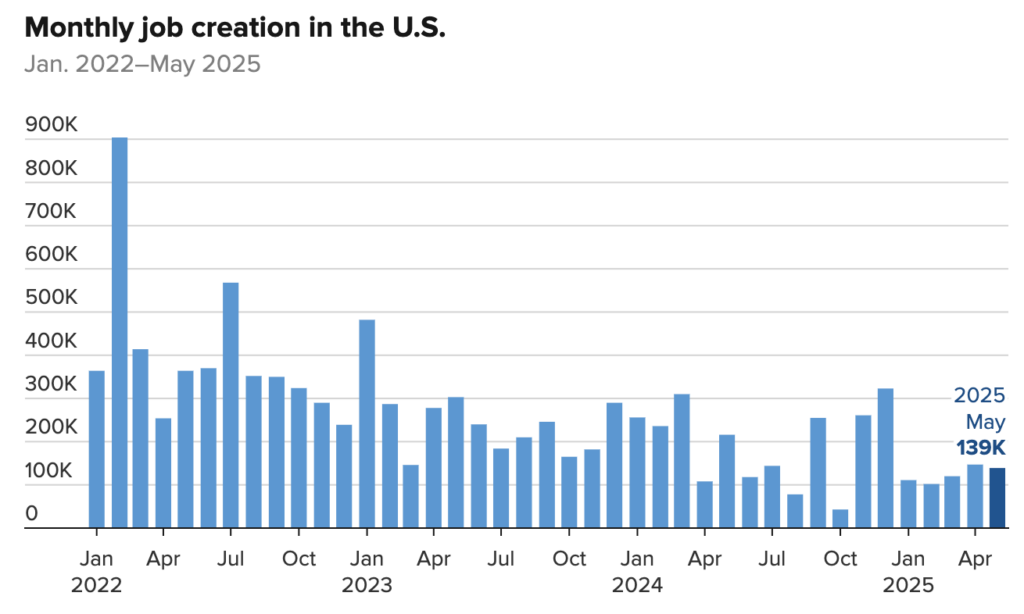

Labor Market: Stable, but Slowing

The U.S. economy added 139,000 jobs in May, a modest gain that suggests the labor market is cooling without collapsing. Wages grew 3.9% year-over-year, down slightly from earlier in the year. While this slower wage growth helps ease inflation pressures, it also signals reduced household buying power, which could negatively affect home demand.

In the Bay Area, layoffs in tech and biotech have moderated, but employers remain cautious. Many are hiring selectively, and hybrid work policies continue to influence where—and how—people want to live.

One emerging force in the regional labor market is artificial intelligence. While AI is boosting productivity and spawning new high-wage roles in fields like machine learning and model deployment, it’s also contributing to the erosion of entry-level job openings in marketing, customer service, paralegal research, and administrative support. Companies are increasingly using AI tools to automate routine tasks, reducing their need to hire junior staff. This has made it harder for recent college graduates and early-career professionals to break into traditional pathways, particularly in tech-adjacent roles that once served as stepping stones.

The Fed Response

As expected, the Federal Reserve left interest rates unchanged at its June meeting. But in a notable shift, several Fed officials—including Governor Christopher Waller—signaled support for a potential rate cut as early as July, if inflation trends continue to improve.

Still, Fed Chair Jerome Powell warned that new trade tariffs and geopolitical uncertainty could complicate the picture. With tariffs being reinstated on steel, aluminum, and potentially appliances and vehicles, the Fed is watching closely for inflationary spillover effects before making a move.

Tariffs Return, Raising Cost Concerns

The Trump administration’s renewed focus on protectionist trade policy is beginning to ripple through the housing market. In early June, the White House doubled tariffs on imported steel and aluminum from 25% to 50%, citing national security concerns under Section 232. Later in the month, those duties were expanded to include a broad range of steel-derived household appliances—including refrigerators, dishwashers, ovens, dryers, and garbage disposals—making it significantly more expensive to build or renovate homes.

In parallel, a blanket 10% tariff on most other imports (excluding Canada and Mexico) took effect in April, with a second wave of so-called “reciprocal” tariffs now delayed but expected to resume in early July. These new trade barriers are already impacting the cost of durable goods. In fact, the price of major household appliances jumped 4.3% in May alone, the sharpest monthly increase in over a year.

Economists estimate that these tariffs could add $8,000 to $12,500 to the cost of an average new home. For the Bay Area, where labor and permitting costs are already high, this could further erode affordability and extend construction timelines. Renovators and house flippers are also feeling the pinch, with higher prices on fixtures, materials, and appliances straining project budgets.

While the Federal Reserve continues to emphasize core inflation—particularly in the services and shelter sectors—as its primary guidepost, officials have acknowledged that tariffs are creating additional inflationary pressure. Some analysts estimate that the tariffs have added about 0.2 percentage points to headline inflation, complicating the Fed’s already delicate path toward interest rate cuts.

For buyers, this means continued cost pressures on both new construction and remodeled homes. For sellers, it adds another layer of uncertainty—especially for properties that may require prep work or upgrades before hitting the market.

In short, tariffs are back, and their effects are being felt throughout the housing ecosystem. As we head into July, continued trade policy changes could further shift pricing dynamics, buyer sentiment, and the broader inflation picture.

Consumer Sentiment Bounces (Slightly)

In a bright spot, the University of Michigan’s consumer sentiment index rose 16% in June, its first increase in six months. While the index remains well below pre-pandemic levels, consumers appear to be feeling more confident about inflation stabilizing and the potential for rate relief.

That said, confidence remains fragile. Many households still expect their financial situation to worsen, limiting their appetite for major purchases—including homes.

What This Means for Berkeley Buyers and Sellers

Buyers should expect continued competition for well-priced homes, especially those in move-in condition. However, elevated mortgage rates are limiting affordability, and many buyers are being more cautious. If you’re shopping this summer, work with a lender early to understand your borrowing power—and consider locking a rate if you’re serious.

Sellers are in a nuanced position. While low inventory continues to support home values, fewer buyers means that overpricing can lead to stale listings. Pricing strategically, preparing longer sales cycles, and leveraging experienced representation are all essential.

Looking Ahead: Will Rates Drop in July?

Markets are now pricing in a meaningful chance of a July or September rate cut. If inflation continues to cool and tariffs don’t spike prices, the Federal Reserve may finally begin to ease policy. That could lead to slightly lower mortgage rates heading into the fall.

In the meantime, real estate activity remains hyper-local. Homes in desirable Berkeley neighborhoods with good light, smart floor plans, and outdoor space continue to attract strong interest. But buyers are choosier than ever, and anything with elevated fire risk, deferred maintenance or poor layout is sitting longer.

Conclusion

As we move through the heart of the summer real estate season, the market remains caught between opposing forces. Slowing inflation and a more dovish Federal Reserve outlook offer reasons for optimism, especially with the possibility of interest rate cuts later this year. At the same time, renewed tariffs, elevated mortgage rates, and affordability concerns continue to shape buyer behavior and cool certain segments of the market.

In Berkeley and surrounding East Bay communities, demand remains strong for well-prepared, thoughtfully designed homes. Buyers are highly discerning, and homes that lack functional layout, natural light, or systems updates are seeing longer days on market. Meanwhile, rising renovation and appliance costs—driven in part by tariffs—are influencing decisions on both sides of the transaction.

If you’re considering buying or selling a home this year, now is the time to develop a smart, data-informed strategy. I’d be happy to help you evaluate your options and navigate this evolving landscape with clarity and confidence.