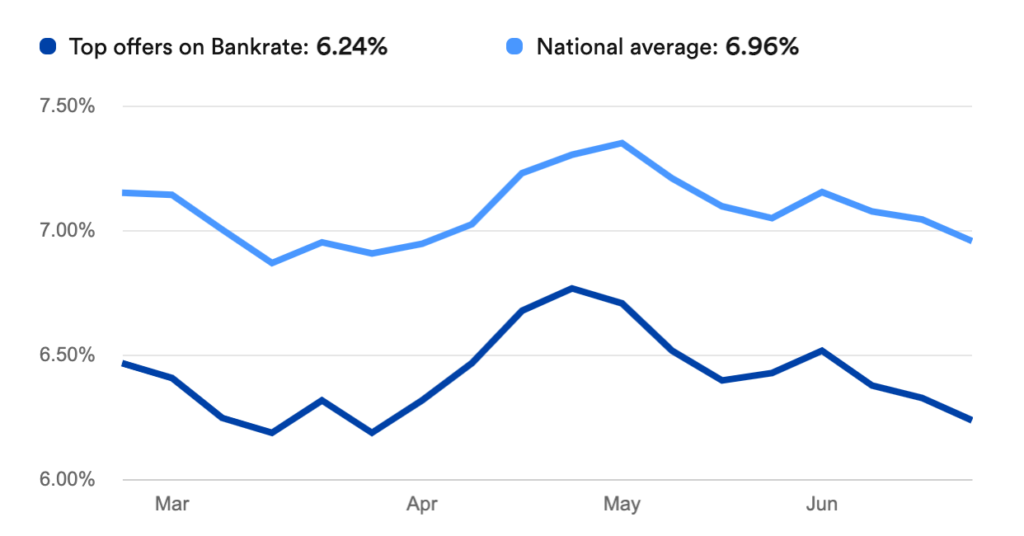

Welcome to my June 2024 real estate market update! Following early year optimism that inflation had been tamed, the Fed signaled 3 interest rate cuts throughout 2024 in their March Summary of Economic Projections (SEP). Unfortunately, data subsequently released through the spring showed a surprisingly resilient economy and job market. This threw cold water on expectations that the Federal Reserve would reduce interest rates as quickly as hoped. May market data finally demonstrated some slowing which again encouraged equity markets. While the Fed held rates steady at their June meeting and modified the SEP to expect just a single rate reduction before the end of the year, mortgage interest rates have slightly retreated in the past few weeks.

There are several new reports on the horizon that should begin to clarify the economic picture and provide clues about what to expect for the real estate market in the the months ahead.

Current Market Conditions

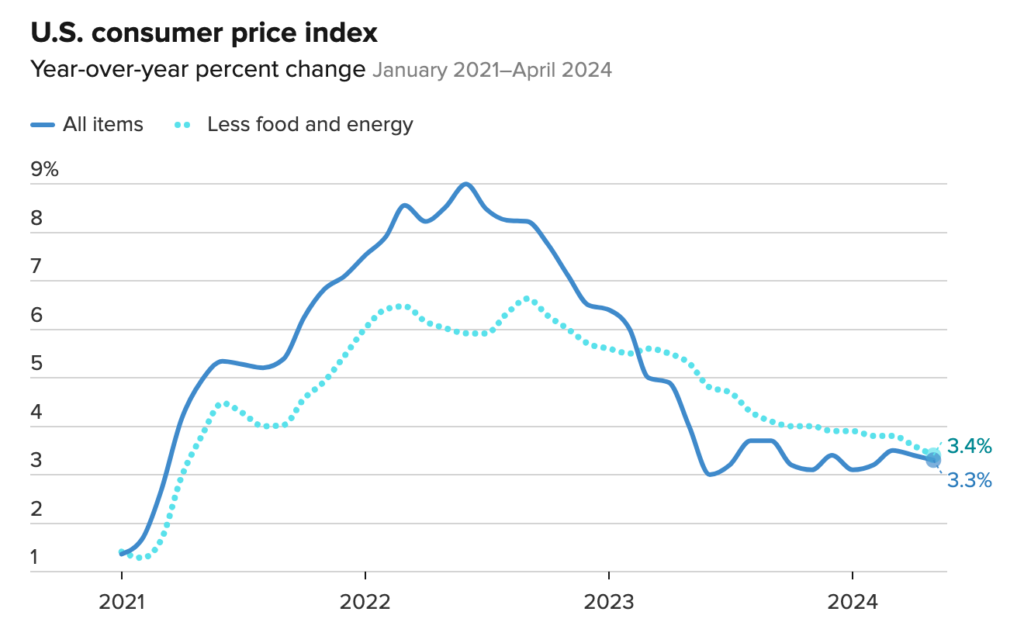

The May Consumer Price Index report showed that inflation had unexpectedly dropped to 3.3% from 3.4% the prior month. A 3.6% drop in gasoline prices was largely responsible for the reduction, though they are still up 2.2% for 2024. Importantly, the core index (excluding food and energy costs) dropped to 3.4% for the year, which is the lowest in the past 3 years.

Of course not all the news was positive. The shelter category (rent and rent equivalents) rose 0.4% for the month and is up 5.4% for the year. Shelter accounts for about 30% of the core index, reflecting the relative proportion that rents account for in monthly budgets. So as long as housing costs remain elevated it will be challenging to address the ‘last mile’ of inflation reduction. As I’ve discussed in past market updates, the United States continues to face a substantial housing gap with demand for homes outpacing supply by a large margin. This is the primary factor that is keeping shelter costs elevated and there is no reason to believe that this component will see relief in the near future.

Another gauge of inflation closely watched by the Fed is the Producer Price Index which measures input prices for companies and is heavily weighted toward energy costs. Economists were expecting this measure to increase by 0.1% in May, but unexpectedly came in 0.2% lower than the prior month.

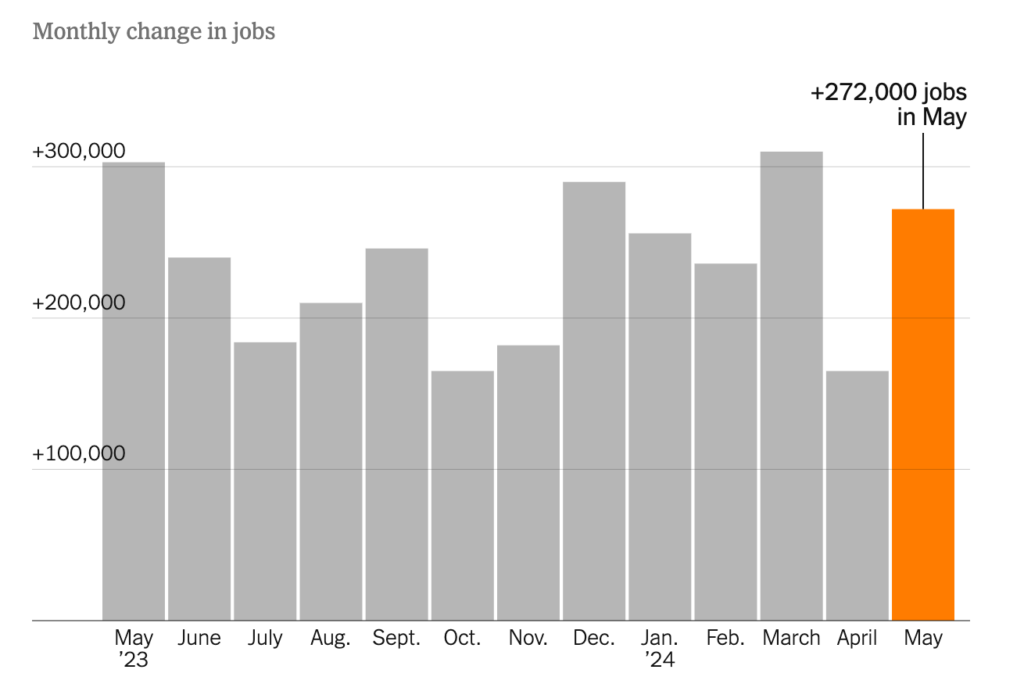

To counter some of the positive news on moderating economic growth, the May jobs report came in much hotter than expected with 272,000 new jobs created up from 165,000 new jobs in April. In addition, wages grew in May with hourly rates increasing 4.1% over the prior year. More money in the pocket of workers tends to lead to more spending which keeps prices, and inflation, elevated. The only moderating data in the jobs report showed unemployment tick up slightly to 4%, the first time we’ve seen the jobless rate above 4% in over two years.

It’s worth noting that jobs data is often revised in subsequent weeks, so we may see a slightly lower number come out in July, but regardless, hiring has continued at a relatively strong pace.

What’s Next?

If economists’ predictions hold true, there will be more encouraging news about inflation later this week. The Personal Consumption Expenditures (PCE) Index, which the Federal Reserve favors as an inflation gauge, is expected to show little change for May. The core PCE reading, which excludes the volatile food and energy sectors, is anticipated to rise by a modest 0.1%.

This would bring both the overall PCE index and the core index to 2.6% for the 12 months ending in May, slightly below April’s figures. This would reinforce the notion that inflation is continuing to cool after previous concerns that the progress had stalled.

A broader perspective reveals optimism from top Federal Reserve officials about the continuing cooling trend. In a recent speech, Fed Governor Adriana Kugler highlighted several reasons for this positive outlook.

She noted that consumers increasingly resisting price hikes might lead to slower price increases or even declines. Kugler observed that consumers are opting for lower-cost products, prompting businesses to offer more discounts. Additionally, she pointed to advancements in productivity, particularly through the adoption of AI technology, which could enhance efficiency without fueling inflation.

The Impact On Real Estate

Home prices spiked 6% in May compared to the prior year. Unsurprisingly, existing home sales dropped nearly 3% from the prior year. Also, the Case-Shiller index, a leading measure of home prices, hit an all time high this past March.

Interestingly though, available home inventory was up 6.7% from April and 18.5% from one year ago. This seems counterintuitive. Prices are rising and sales are dropping amid an increase in inventory.

Another thing to consider about housing costs, particularly for renters, is the lag in data. CPI data looks at new leases each month and how those costs compare to the prior period. However, many renters are in long-term or month-to-month leases that may be at lower rates than current rental markets indicate. Given the relative lack of housing units compared to demand, this likely means that as people move and sign new leases at higher rates, we will continue to see elevated housing sector inflation for some time in the future.

Conclusion

The early spring market saw fast sales and comparatively high prices in part due to the positive inflation data that likely gave buyers confidence that mortgage rates would moderate later in the year. This led them to believe they could buy now at relatively high rates and refinance in the near future to bring monthly mortgage payments down. Sellers also reacted to this early spring data by preparing their homes for sales in anticipation of future rate decreases.

What followed though was a string of disappointing data that saw a rise in mortgage interest rates and less confidence that rates would come down in 2024 (and even the possibility that rates might increase). We then saw a jump in housing inventory in late spring, just as buyers pulled back. This led to longer days on market, fewer offers, and overall softening prices.

Yet there is reason for optimism. Mortgage interest rates have continued a slow decline and I saw a 30-year fixed conventional mortgage this week at just 6.625%. I forecast that we’ll see rates drop below 6% sometime in early 2025 so refinancing will become viable for those who purchase this summer or fall.

If you ever have any questions about the real estate market, economic trends, or advice on buying or selling, please reach out to schedule a call.