We’re now well into 2023 and there is a slew of new national economic data for us to chew on. The January Consumer Price Index (CPI), the Commerce Department Retail Sales report, and the Congressional Budget Office (CBO) 10-year forecast for the economy and the national debt were all released in the past few days. Markets have been digesting this data which has led to some volatility, but nothing particularly surprising. Now is our opportunity to review the information and try to interpret what it means for the future of the national, and more importantly, local real estate markets.

Current Market Conditions

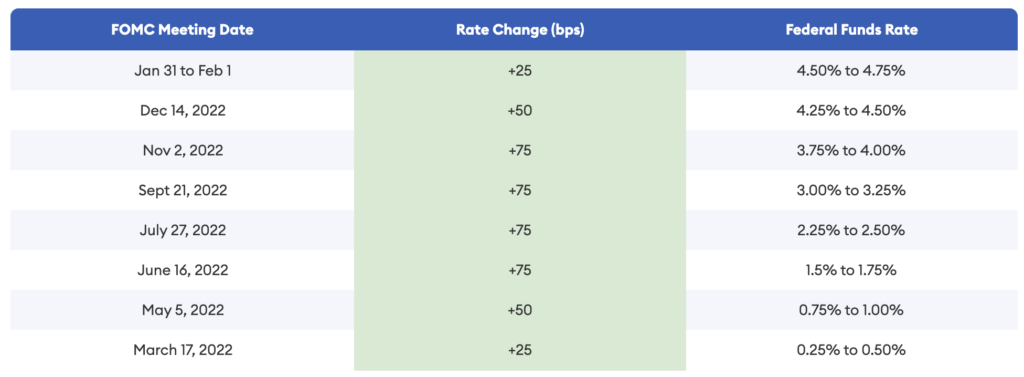

Let’s start with the CPI report. Inflation rose slightly in January after coming down over the past few months. Overall prices were up 0.5% from December with the biggest jump coming in the shelter category. Let’s put a pin in the shelter discussion for the time being. Year-over-year inflation is now up 6.4% from January of 2022 while the Federal Reserve is targeting annual growth at about 2%. While inflation is down significantly from last summer when it peaked at 9.1%, we’re still a ways off from the Fed’s target rate. Remember that this growth has come in the face of 8 interest rate hikes for a total of 4.5% in the past 12 months.

Particularly notable in the CPI report was that shelter costs accounted for about half of the total increase. Shelter includes rents and their equivalents for homeowners (based on local comparable rent expenses). Rents are actually up 7.9% from the prior year while the overall CPI has risen just 6.4%.

The Retail Sales report also surprised analysts by jumping 3% in January from the prior month, the largest increase in nearly 2 years. Spending was down in December but was then up again across every major retail category in January. This was accompanied by a particularly robust January jobs report which saw the economy add more than 500,000 new jobs, so clearly consumers were feeling confident last month.

Finally, the CBO released their 10-year forecast and the data is sobering to say the least. The U.S. is on track to add nearly $19 Trillion to the national debt over the next decade. This is $3 Trillion more than was projected by the CBO as recently as last spring. This will push the total of our national debt to approximately $50 Trillion by 2033 which will be nearly 120% of GDP. This increase in the total debt is driven by increasing deficit spending, in part due to rises in the costs of entitlements including Social Security and Medicare.

Why It Matters

The underlying economic questions we’re trying to answer is how long will the Federal Reserve continue to raise the prime rate in an effort to fight inflation, and what will this mean for mortgage interest rates. The Fed has continued to signal that we’re not out of the inflationary woods yet, but it appears that consumers and the market more generally didn’t take this message to heart in January. Business hired a historic number of new workers and consumers responded by continuing to spend aggressively.

There is also some concern for the long-term deficit spending trends. While we can’t predict how spending will impact the real estate market years in the future, some analysts propose that an improvement in worker productivity could help offset some of these concerns. In any case, a tight housing market where demand will continue to outpace supply is going to drive pricing considerations for the foreseeable future.

What This Means For Real Estate

The economy continues to grow and the unemployment rate is at historic lows. Consumer confidence is high and up to this point the interest rate hikes imposed by the Fed do not seem to be leading the economy anywhere close to a recession. However, ongoing inflationary pressure means the Fed will likely continue to raise interest rates throughout 2023 to continue to combat inflation. This will keep mortgage interest rates elevated which will dampen demand for housing purchases.

This trend is also tied to the CPI report. Shelter costs, and rents in particular, are continuing to climb. If fewer people are able to afford to buy a home due to high mortgage interest costs, more people will continue to rent which will put ongoing pressure on rental rates. Short of building a slew of new housing units, which can take years to permit and develop, we aren’t likely to see an end to higher shelter costs anytime soon.

Mortgage interest rates crept up this week after the economic data was released, averaging 6.12% for a 30-year fixed loan. This is up just slightly from 6.09% last week, but still down considerably from the peak last summer when rates passed 7.0%. Most analysts still expect that rates will moderate to around 5.5% by the end of 2023, but there is some uncertainty about these projections given the most recent economic data. In short, rates are likely to increase further before moderating and then coming down late in 2023. This argues for moving quickly if you’re interested in getting into the market soon.

And One More Thing…

The government has technically reached its debt limit, the amount of money it can legally borrow to pay its financial obligations. Through accounting measures, the government will continue to operate through the early summer. However, at some point in July or August (depending on income tax payments in April) we will no longer be able to pay our bills unless congress passes legislation to extend the debt limit.

This means an upcoming political fight over spending priorities. In theory a small group of congresspeople in the House of Representatives could prevent the government from borrowing more money unless their policy and fiscal demands are met. This would put the “full faith and credit” of the United States at risk which could throw the global economy into recession, or worse.

This has never actually occurred before as there has always been a last minute deal to avert default. This is very, very likely to be the outcome this summer as well. That said, the uncertainty of the timing and the threat of default could wreak havoc with financial markets in the late spring and summer.

This could could throw a wrench in any economic forecasts. It’s impossible to predict how markets might respond to this threat or when congress will come to a resolution of the debt limit crisis. In short, stay tuned to see how this plays out.

Conclusion

Uncertainty remains the norm, but a tight housing market and robust economy means that real estate will continue to appreciate in value and remain a great long-term investment. Also, regardless of all the up and down economic news, mortgage interest rates still remain at historically low levels. If you would like a free home valuation please don’t hesitate to contact me for more information. If you are considering purchasing a home I can set-up an automated search with your detailed criteria which will be emailed to you daily.

Regardless of where you are in your real estate journey, I’ll continue to provide regular market updates, and don’t hesitate to reach out if I can answer any questions for you or your friends and family. Till next month!