As we approach the end of 2023, we also appear to be at the end of a cycle of rising interest rates. A slew of recent economic reports have apparently convinced the Federal Reserve that their effort to combat inflation has been successful and it is time to halt further rate increases. While I agree with this assessment, some analysts believe the Fed may have gone too far in their monetary tightening policy which may result in a recession early next year. What does this mean for the real estate market? In my December 2023 real estate market update we’ll look into the recent data and some choice words from Federal Reserve Board Chair Jay Powell for insights.

Current Market Conditions

The November jobs report was released in early December with the unemployment rate dropping from 3.9% to 3.7% from the prior month. Economic analysts expected 186,000 new jobs, but were surprised by the creation of 199,000 jobs. While hourly wages rose 4%, that was down from 5.9% last year, thus easing some worries that robust jobs and wage growth will continue to contribute to ongoing inflation. It’s notable that this jobs growth figure is just above the Fed’s target rate of 3.5%. Overall, this report is seen as strong yet moderating – exactly what we would like to see of a gradually cooling economy.

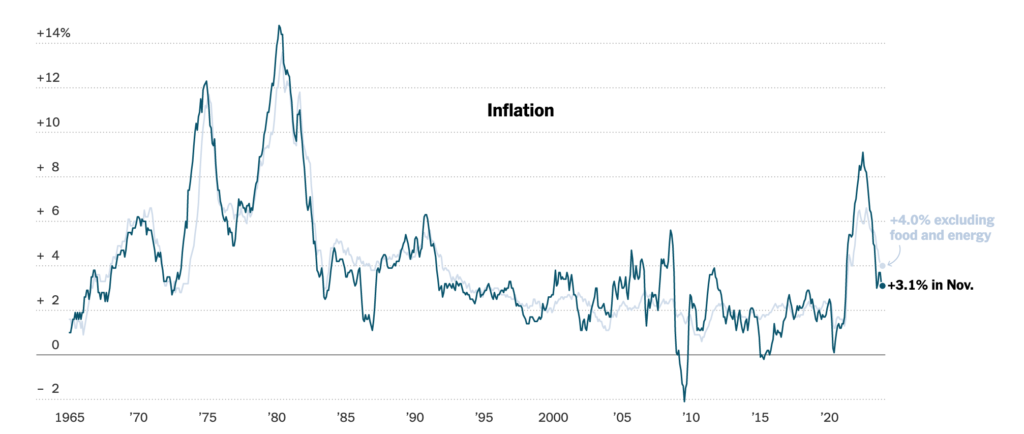

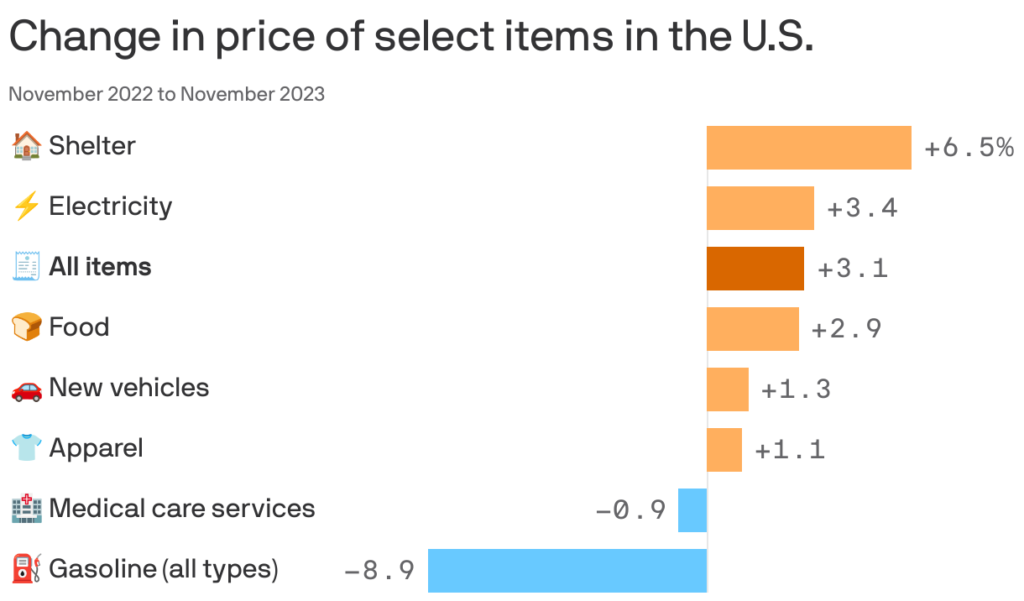

The November Consumer Price Index (CPI) report showed that prices grew 3.1% from the prior year, down 0.1% from the month of October. While not a dramatic change from the previous period, this was yet another indication that inflation has cooled and continues to approach the 2.0% level that the Fed is targeting.

It’s useful to also examine the underlying core inflation rate which excludes volatile food and energy prices. Core inflation was up 4% compared with November of 2022, and was unchanged from October.

Looking closer at some of the sub-categories that make up the CPI, shelter remains one of the items that has shown the most growth and represents about one-third of the core index. This is an indication of both a general lack of housing units, and the comparatively low inventory of existing homes for sale.

The Federal Reserve board of governors met on December 13th for the final time of 2023 and voted to leave the Fed rate unchanged in the 5.25% – 5.50% range. While this was broadly expected, comments by fed Chair Jay Powell following the meeting indicated that the Fed intended to reduce rates by as much as 0.75% in 2024. The forecast that the Fed would make up to three rate cuts next year, four in 2025, and another three in 2026 was met favorably by the market. The S&P 500 rose 1.4% and is just shy of the market high of January 2022.

What This Means For Real Estate

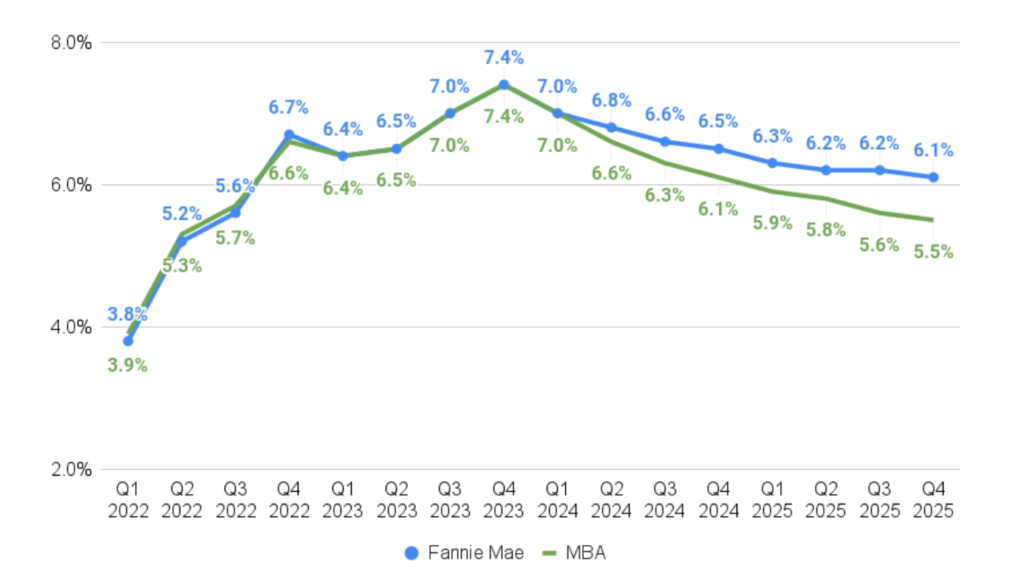

The short version is that mortgage interest rates have begun to come down over the past weeks, mirroring the 10 year treasury bond yield. 30-year fixed mortgages are averaging just below 7%, down from nearly 8% less than 6 weeks ago. Almost more important are the forecasts for rates over the next 24 months.

While there is some disagreement on how the Fed rate cuts will impact mortgages, both Fannie Mae and the Mortgage Bankers Association (MBA) see mortgage rates dropping to between 5.5% – 6.1% by the end of 2025.

This is likely to be a boon for both buyers and sellers. Lower rates mean greater affordability for buyers. It also means more demand for sellers, but also makes it easier for home owners to give up the historically low refinance rates they received in the 2020-2022 period. So while we expect to see more inventory coming on the market early in 2024, competition for limited homes will increase, keeping home values relatively elevated.

My advice to buyers is to move quickly. With lower rates comes more competition and higher prices, so get into contract as quickly as possible. If rates do drop to 5.5% or so during the next 18-24 months, you will be well positioned to refinance and lower your monthly payment.

Lower rates will also mean more listings, so sellers will also benefit from listing relatively soon. The spring selling season runs from late January through early June so now is a great time to find an exception real estate agent to help you prepare your home for market.

Conclusion

It’s been a bumpy ride for the past few years, but it appears that the Fed has pulled off an illusive ‘soft landing’. However, even if it turns out that the Fed overshot interest rate hikes and the economy tips into recession early next year that could still bode well for the real estate market. If the Fed finds it has to cut rates more quickly than currently expected, we will likely see an even more active year of real estate transactions than currently expected.

Regardless of all this news, I continue to counsel my clients that you can’t time the market. The best time to buy is as soon as possible assuming your investment window is at least 3-5 years. Begin building equity now based on what you can afford, and look to upgrade or refinance as circumstances evolve. And for sellers, let life circumstances dictate your timing. Regardless of the markets, life goes on and I’ll be there for you at each and every change.

Thank you to everyone for your trust in me and for helping me be the best real estate professional I can be. I wish you and your family a happy new year and look forward to speaking with you soon.