There are changes afoot for solar power users in Berkeley and the surrounding Bay Area. It has to do with how you are compensated by Pacific Gas & Electric for feeding solar power back to the electrical Grid. Solar net metering is a term used to describe the amount of electricity your home draws from the electric grid after accounting for power generated from the solar panels on your roof.

What Is Solar Net Metering?

Also known as net energy metering (or NEM) this solar incentive framework effectively allows you to store energy in the electric grid. When your solar system generates more energy than you are using, you can sell any excess electricity production back to PG&E and receive credits (known as the export rate) to your monthly bill. Then, at night or other times when your solar panels are producing less power than you consume, you draw energy from the grid and use these credits to offset the costs of that energy.

Traditionally, solar net metering was compensated at a one-to-one offset, meaning that you paid the same rate for electricity that you pulled from the grid, as the credit you received when supplying the grid with excess power from your solar panels.

This has been a great incentive to install solar on your home, which helps offset the use of fossil fuels and reduce greenhouse gas emissions. In addition to the benefits of NEM, there is also a federal tax incentive available to offset the cost of installing a new solar system. Let’s take a quick look at the history of the solar tax credit and what it may mean for you.

Solar Tax Credit

The Energy Policy Act of 2005 offered home owners a federal Investment Tax Credit (ITC) of 30% as an incentive to invest in solar panel systems for their property. This was part of an effort to address concerns over climate change by shifting away from fossil fuels for energy production. However, the ITC was initially capped at $2,000 which hampered the growth of renewable energy, particularly when compared with tax incentives for fossil fuel development. When the Obama administration came into power in 2008, they removed the $2,000 cap to further incentivize the adoption of renewable energy.

The tax credit was initially scheduled to phase out over a number of years but congress extended the credit multiple times due to its popularity and the job creation that resulted from the demand for solar systems. As part of the Inflation Reduction Act passed in the fall of 2022, Congress again extended and expanded the ITC. Currently, owners of new residential solar systems can deduct 30 percent of the cost of the system from their taxes through 2032 with the credit declining to 26% and then 22% over the next two years before expiring.

NEM 2.0

The current NEM 2.0 program was adopted by the California Public Utilities Commission (CPUC) on January 28, 2016, and is available to any customers of PG&E who have solar panels installed on the roof of their home. Put simply, the program provides customers rate credits for any energy exported to the grid.

Under NEM 2.0, solar owners are credited for the full retail value of each kWh of electricity they provide to the grid. On average, the current export rate under NEM 2.0 is about $0.30 / kW.

Unfortunately, the current NEM program is scheduled to expire on April 14, 2023 in favor of a new NEM 3.0 framework.

NEM 3.0

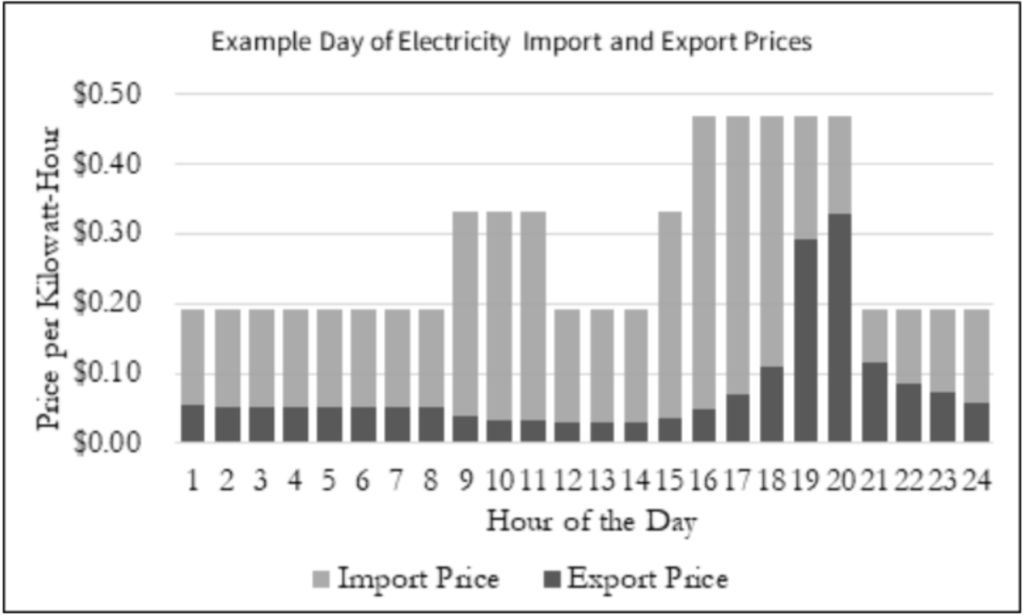

On December 15, 2022, The California Public Utilities Commission (CPUC) passed NEM 3.0, a new net metering policy that will ultimately reduce the monthly energy bill savings for new solar owners. Under the NEM 3.0 program, the value of solar exports are no longer be based on retail rates. Export prices are be based on the “Avoided Cost Calculator” and vary by the month and hour.

Under NEM 3.0 PG&E will credit net energy exports at just $0.08 / kW, a reduction of 75% in the export value from the NEM 2.0 regime. Depending on the time of day, customers will purchase energy at an import rate that is between 2 and 4 times more than they will be credited for the export rate:

This means that the benefits of solar net metering will be dramatically lower under the new NEM 3.0 rules after April 13, 2023.

How NEM May Impact Your Property Value

Since the NEM 3.0 framework will provide for a dramatically reduced export rate, you have a strong incentive to install solar panels as soon as possible if you don’t already have them on your home. Based on the most current timeline for NEM 3.0 implementation, Berkeley residents have until April 14, 2023 to submit interconnection paperwork to be grandfathered into NEM 2.0 for 20 years. Your solar installer then has up to 3 years to complete the installation of the system.

Another important benefit of achieving NEM 2.0 program participation is the potential value it can add to your property when you decide to sell. Under the NEM 2.0 rules, eligibility for the higher export rate net metering payments transfer to a new owner for the duration of the 20 year grandfather period. This means that when you go to sell your home you can market it as a NEM 2.0 compliant property that offers the new owner substantially lower electricity costs!

Depending on the size and orientation of your roof and your annual electric consumption, the payback period for a solar system including tax incentives can be as little as 7 years.

Clearly, installing solar is a smart financial decision. In addition to the availability of the 30% ITC to help defray the cost of a solar installation, a number of studies have demonstrated the positive impact that solar panels have on home resale value. According to a recent Zillow report, homes with solar panels sell on average for 4.1% more than comparable homes without solar across the US. A study conducted by Berkeley Lab, also found that homes with solar panels tend to sell faster than those without. These benefits along with NEM 2.0 transferability make solar a no brainer choice.

What Should I Do Next?

If you don’t have solar on your home and you’re interested in learning more about how you might qualify for the NEM 2.0 program from PG&E, contact me to discuss your situation. I have a number of solar installer recommendations for you. In addition to purchasing and installing the solar system, many of these vendors provide financing options, and can also manage the paperwork with the utility to make sure you get approved before the deadline.

Even if you aren’t ready to install solar today, there will still be benefits to enjoying distributed power generation on your home under the NEM 3.0 program. While the export prices will be going down, the new rules offer you other benefits if you install a battery back-up system along side your solar panels. The details are best communicated by a vendor with expertise in navigating the complex electric utility bureaucracy, but I’m happy to provide you with a qualified recommendation.

Regardless of where you are on your sustainability journey, I’d love to be a resource for anything green home related. Always feel free to contact me for advice, recommendations, or just to learn more.