We’re nearing the end of the summer season, which means the start of the fall selling season and time for my August 2023 real estate market update. Inventory typically rebounds after Labor Day, but given relatively high mortgage interest rates, many property owners remain locked into their sub 3% refinance rates and are hesitant to sell. I’m also going to look at the most recent inflation data as well as some other macroeconomic global indicators to form a picture of where the Berkeley real estate market may be headed in the next several months.

Current Market Conditions

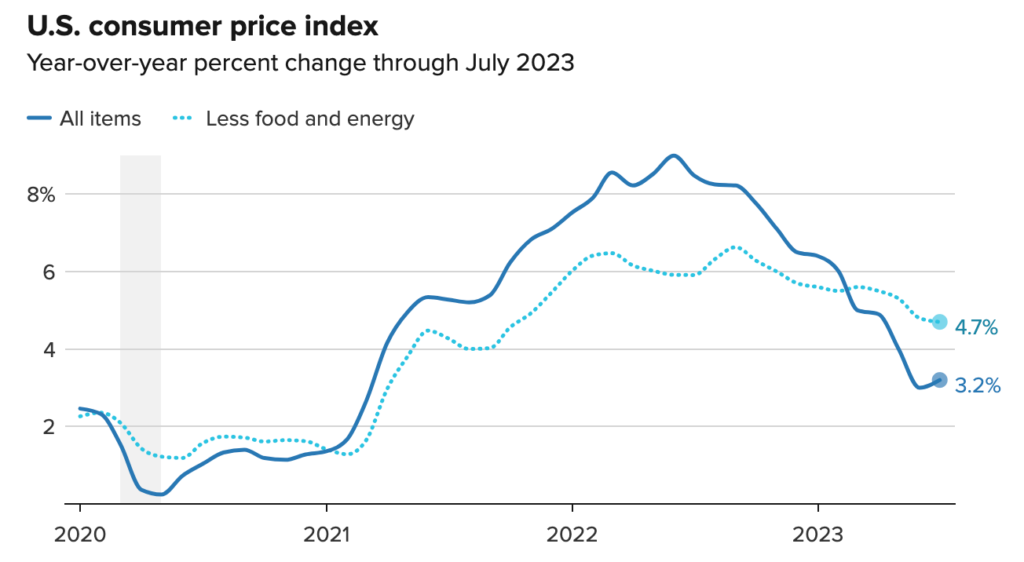

The July Consumer Price Index report was released on August 10th and showed that consumer prices grew 3.2% from the year before. Core inflation (excluding food and energy) grew at 4.7% which is the lowest value since October of 2021. Both numbers were slightly better than analyst expectations.

Rent (which includes rent and homeowner rent equivalents) accounts for nearly 30% of the index which means that category has a disproportional impact on the CPI compared with other spending categories. For July, rents were up 7.7% from the prior year which represents nearly 90% of the total increase for the index. This shows that housing prices remain elevated throughout the country.

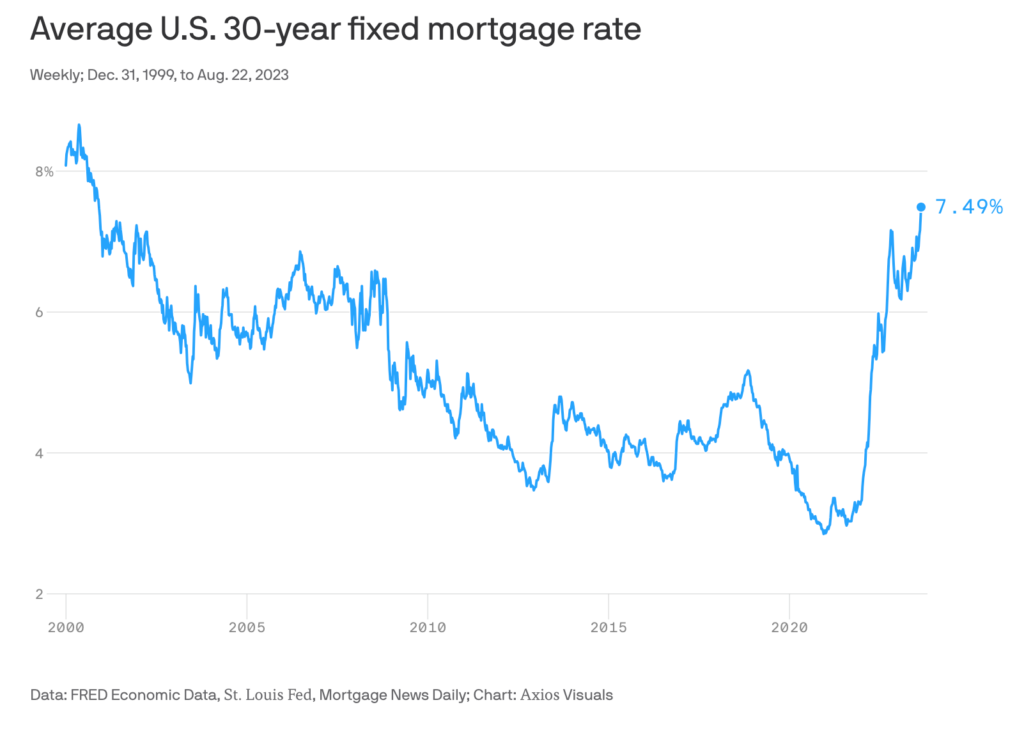

In the meantime, mortgage interest rates continue to climb. The conventional 30-year fixed rate mortgage approached 7.5% this week which is the highest level we’ve seen since 2000.

Unsurprisingly, mortgage applications are at 28-year low. More than a third of prospective buyers have reported that high rates are holding back purchases.

Why It Matters

While inflation has moderated somewhat due to the Fed’s campaign of interest rate increases, prices increased slightly from June to July, which is the first time we’ve seen a month-to-month increase in the past year. In addition, the Fed has a 2% inflation target which is still a ways off from the current level of 3.2%. The ‘last mile’ of inflation reduction may be the hardest part to achieve. With the unemployment rate hovering at a historically low 3.5%, and real wages continuing to climb, people have some money in their pocket to spend which keeps prices elevated.

Also, that stubborn ‘rent’ category is keeping the inflation numbers above the target rate, and without lower mortgage interest rates along with additional housing stock to satisfy demand, it is unlikely we’ll see that number decline substantially in the coming months.

This leads to the question of what the Fed will do in the next stage of inflation management. They may choose another rate hike, or optionally, let the current rates hold for an indefinite period of time. Ultimately, the height of the plateau may not be as important as how long higher rates are held.

We must remain cognizant of the fact that the Fed rate is not directly tied to mortgage interest rates. Of course it’s also worth reminding everyone that in 1981 mortgage interest rates peaked at above 16%, so rates remain relatively modest by historical standards.

What This Means For Real Estate

Given how stubborn inflation appears to be and the fact the employment and wage growth are both healthy, it could be quite some time before we see the Federal Reserve Board begin a campaign to lower interest rates.

If that is true, we can expect continued inventory constraints, lower affordability, and fewer transactions in the market for the remainder of 2023.

Many analysts expect that we’ll begin to see rates decline at the beginning of 2024. This doesn’t mean it’s not a good time to purchase a home. When rates do come down, more buyers will enter the market, creating additional competition and a further increase in home prices. Getting in sooner, building equity, and refinancing when rates decline may be a better strategy in the long-run.

Global Forces

Given how robust the U.S. economy has been over the past several years, it’s surprising to learn that China has recently been struggling with negative growth. The Chinese Central Bank unexpectedly cut rates last week for the second time in the last 90 days.

Years of central government spending to juice the economy led to unsustainable infrastructure investments, particularly in housing. Many of those projects are now saddled with debt amid rising interest costs which is leading to bankruptcies and what is effectively a bursting housing bubble. This is one of the factors that is leading the central bank to cut rates.

We have also seen a drop in the trade surplus as Chinese exports have plunged amid declining global demand for its products. This could be an early indicator of a global recession.

Conclusion

While the U.S. economy remains robust and interest rates look poised to stay at elevated levels, there are other indicators of cracks in the veneer.

In addition to the global outlook, last month I discussed concerns regarding the inverted yield curve for government treasuries. While a global recession would bring the possibility of layoffs and lower employment in certain sectors, it would also lead to consumer prices softening and a more rapid return to a lower interest rate regime.

This in turn would more quickly lead to a reduction in mortgage interest rates which would spurn sellers and buyers alike to transact in property sales.

The timing for these factors is highly uncertain, but it’s fair to say that we won’t see an indefinite period of higher mortgage rates. As with everything in real estate markets, the question is always one of timing.

Regardless of where you are in your real estate journey, I’ll continue to provide regular market updates, and don’t hesitate to reach out if I can answer any questions for you or your friends and family. Till next month!