My April 2024 real estate market update comes with some surprising uncertainty. Early in the year it looked like we were on track for a soft economic landing after nearly 2 years of Fed rate increases. The Fed was forecasting 3 rate cuts throughout 2024 and both the financial and real estate markets responded favorably to the news. Unfortunately, things have not gone according to plan over the past few months with higher than expected inflation and job growth.

It’s somewhat ironic that we aren’t celebrating such a strong economy, but for those looking to buy or sell real estate in Berkeley and the surrounding areas, this is unwelcome news. Higher interest rates mean fewer buyers in the market and little home inventory with sellers locked into their historically low refinance mortgage rates below 3%.

Let’s take a look at the March economic reports and other comments from the Fed to get a better understanding of what to expect for the remainder of 2024 as it pertains to the real estate market.

Current Market Conditions

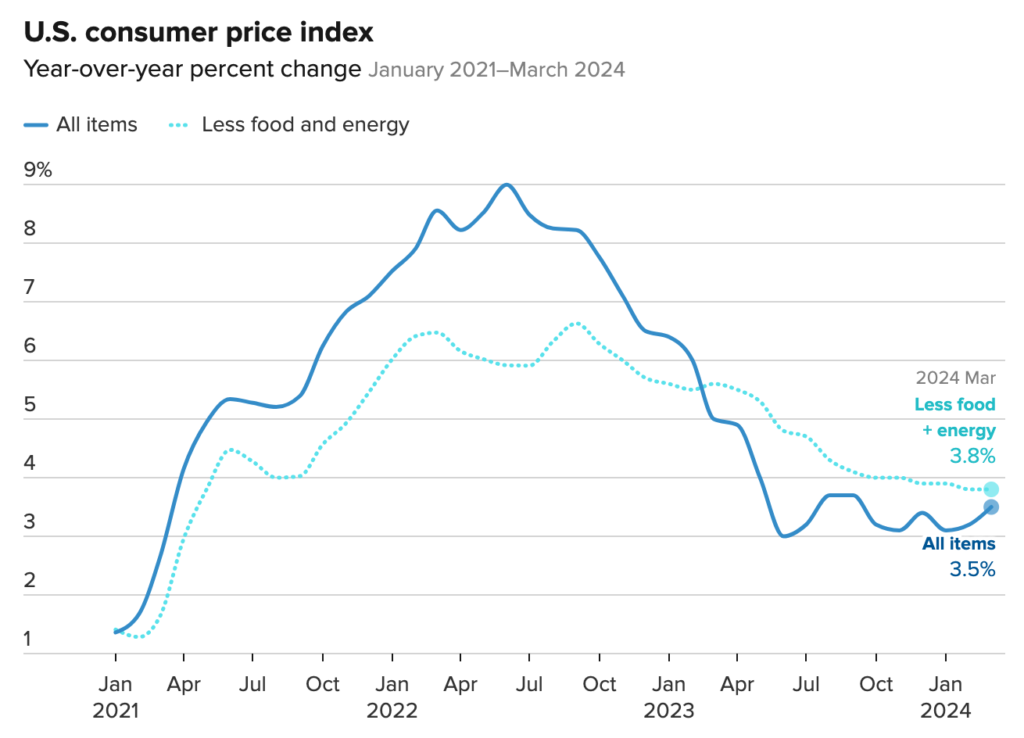

The March 2024 Consumer Price Index report showed inflation increased 0.4% over February and 3.5% over the prior March which was higher than expected.

Given that the Fed has been targeting a 2% annual rate of price growth, there does not appear to be sufficient data to support a June rate cut as was originally expected.

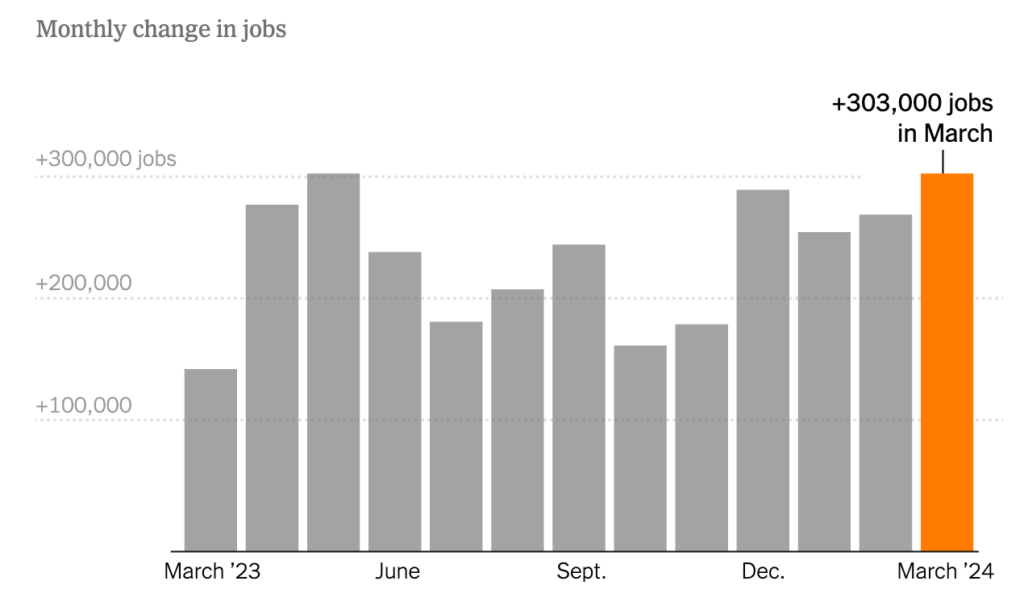

On the jobs front, the March report exceeded expectations with 303,000 new jobs added to the economy, which is the 39th straight month of job growth. The report also saw unemployment drop to 3.8% which is generally considered to be in the range of full employment.

The strength of the job market has been surprising. Analysts suspect that the underlying cause of job growth is residual fiscal stimulus from the pandemic era that is still making its way through the economy. Households that received stimulus checks were spending more than usual, thus generating higher demand for goods and services, which consequently led to job growth from companies looking to meet that greater demand.

While the underlying assumption of the Fed that inflation could be tamed with higher interest rates, we may be facing a new paradigm of persistently higher inflation and interest rates. If the economy can continue to absorb these costs while delivering consistent job growth and economic performance, it may be time to rethink our historic economic models.

The third of eight scheduled Federal Open Market Committee (FOMC) meetings is scheduled to begin on April 30th and analysts now expect that the Fed will continue to hold interest rates steady until there is more concrete economic data to support a future rate cut.

The Impact On Real Estate

Energy and shelter costs accounted for most of the March CPI increase with shelter expenses growing 5.7% from the prior year. There is a bit of a paradox in this data as the Fed has been stating it was expecting shelter costs to decrease enough throughout 2024 to warrant a string of prime rate cuts. As I’ve discussed in the past, shelter accounts for nearly one-third of the CPI and thus has a disproportional impact on the index compared with other categories.

The underlying cause for ongoing high shelter costs is a lack of housing units. As long as demand outstrips supply we’re likely to see upward pressure on housing costs, both for purchasing and renting. This appears to be largely independent of what happens with interest rates. It’s estimated that, across the country, we are short more than 6 million homes to meet anticipated demand.

There are two primary problems contributing to this imbalance. The first is interest rates. Higher borrowing costs deter home builders from proactively invest in new housing ‘starts’. Investors need to make a large financial outlay to build houses before they can sell them and with this comes a fair degree of risk. While interest rates remain high, the risk premiums they demand don’t necessarily meet expectations of buyers.

The second factor is the lack of available land in the most desirable areas of the country where the combination of economic growth, culture, and weather attract the most people. Many cities are reevaluating their long-term development plans with increased focus on multi-family units along transit corridors to both meet housing demand while reducing greenhouse gases associated with long-distance commuting. But these plans take many years to result in new housing units.

Regardless, it doesn’t appear that mortgage interest rates are due for a dramatic decrease in the foreseeable future. Nor is there a line of sight to lower housing costs. If anything, we can anticipate that property values will continue to appreciate indefinitely.

While this may be painful to consider if you’re in the market to buy a home, I encourage my clients to face economic reality. In general, this means that there is little advantage to waiting to get into the market. While we will surely see some fluctuation in rates, my impression is that we may be in a semi-permanent environment of higher rates.

And if rates are going to remain higher, home sellers will need to accept that their super-low mortgage refinance rates are a thing of the past.

Conclusion

While I originally expected we would see the first interest rate cut of 2024 in June of this year, I’m now dubious that we’ll see ANY reduction in rates before the year is out. I’ve even seen reference to some economic pundits proposing that it is possible we could see a rate INCREASE later in the year if elevated inflation continues.

Regardless of rates, the economy remains strong, job growth is extremely healthy, and the housing market is tight.

For both buyers and sellers, let life circumstances dictate your decision path. Births, graduations, marriages, divorces, retirement, and deaths will continue. These are the events that trigger the need to reevaluate housing. Go with the flow and make the decision that makes the most sense for you and your family when faced with a change event. If I can ever be of assistance in helping you evaluate the best move, please reach out for a free consultation. I know that the economic uncertainty we’re surrounded by can be destabilizing, and it may be helpful to get some perspective from someone who deals with the intricacies of real estate day in and day out. In the meantime, hang in there, and I look forward to hearing from you soon!