After a few months away from this newsletter, I’m back and there’s a lot to cover. The year started with a national housing market hangover from December’s strong finish, a fresh round of economic data, and a Federal Reserve that remains in wait-and-see mode. Here in the Berkeley real estate market, though, the story looks quite different from the national headlines. Let me walk you through what matters most.

The Economic Backdrop

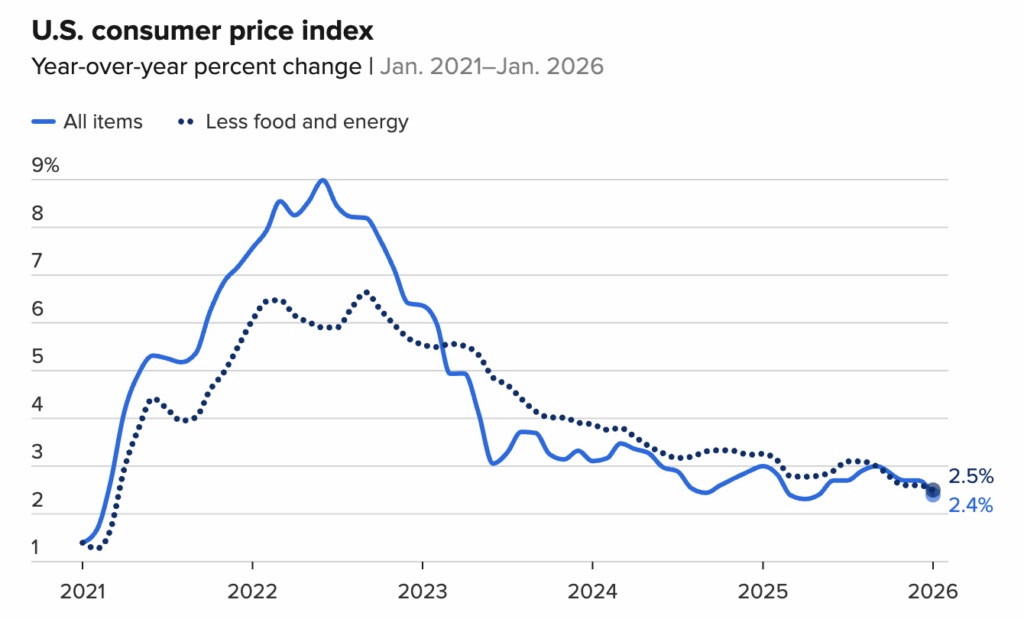

The January CPI report, released February 13, showed consumer prices rose 2.4 percent year-over-year, down from 2.7 percent in December and the lowest annual reading since May. Core inflation (excluding food and energy) came in at 2.5 percent, its lowest since April 2021. Shelter costs, which have been stubbornly high, finally moderated, rising just 0.2 percent for the month. Energy prices fell 1.5 percent. The downside: food inflation remains elevated at 2.9 percent annually, utility gas was up 10 percent year-over-year, and homeowners insurance continues to climb roughly 7 percent – a particular concern in California.

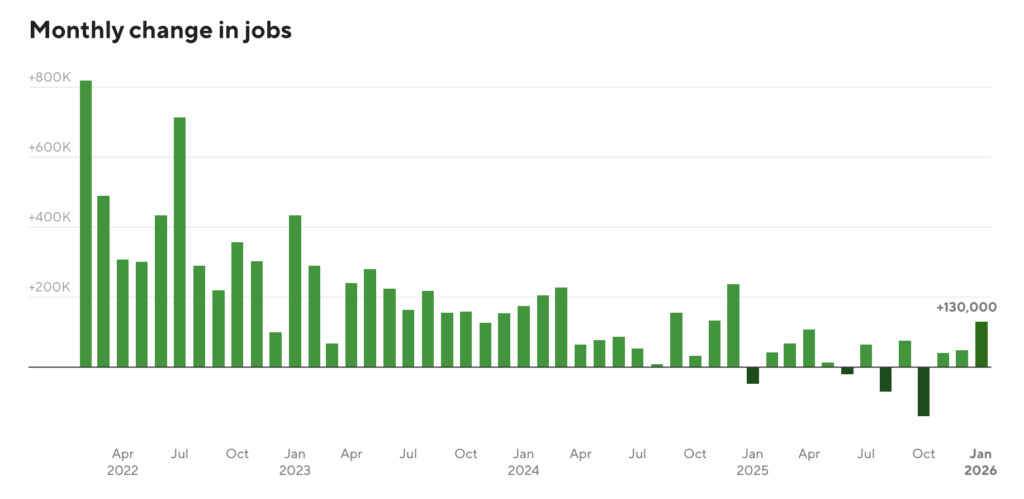

On the jobs front, the economy added 130,000 payroll jobs in January – well above expectations and the best month since December 2024. The unemployment rate ticked down to 4.3 percent. The good news was tempered by the BLS’s annual benchmark revision, which revised down 2025 total payrolls by about 898,000 jobs. The labor market is stabilizing, but last year was considerably weaker than the monthly reports suggested.

The Fed and Mortgage Rates

The Federal Reserve held rates steady at 3.5 to 3.75 percent at its January 28 meeting, pausing after three consecutive cuts to close out 2025. The Fed removed language about heightened downside employment risks – a signal that policymakers see the dual mandate (2% inflation & full employment) as more balanced. Markets now expect the Fed to hold at the March meeting and potentially cut in June, with one to two cuts priced in for all of 2026.

The bigger story for home buyers is what’s happened to mortgage rates over the past year. According to Freddie Mac, the 30-year fixed rate averaged 6.02 percent as of February 17 – a three-year low and meaningfully below the 6.87 percent of a year ago. On a $1.4 million Berkeley home purchase with 20 percent down, that difference translates to roughly $430 per month in lower payments.

National and California Housing

Nationally, existing-home sales fell 8.4 percent in January to an annualized pace of 3.91 million – the sharpest monthly drop in nearly four years. NAR Chief Economist Lawrence Yun partly attributed the decline to an unusually cold, wet January but also called the broader environment a “new housing crisis” – not a price crash, but a market that simply isn’t moving. The median U.S. home price edged up just 0.9 percent year-over-year to $396,800. Inventory improved slightly to 3.7 months of supply, still well below a balanced market’s six months.

California told a similar story. The California Association of Realtors reported January sales of just 256,550 on a seasonally adjusted annualized basis – down 10.8 percent from December – and a statewide median price of $823,180, a 23-month low. Inventory jumped to 4.4 months statewide. C.A.R.’s 2026 forecast still calls for modest improvement – 274,400 in total sales and a median near $905,000 for the full year – but the year will need a strong spring to get there.

Berkeley: A Different Market

January’s local data diverged sharply from state and national trends. The median Berkeley home sold for $1.4 million in January, up 12.5 percent year-over-year. Homes spent a median of 20 days on market – down from 32 days a year ago – and buyers submitted an average of six offers per listing. Twenty-two homes closed in January, on par with last year.

On the ground, well-prepared listings in Elmwood, Thousand Oaks, and North Berkeley are generating multiple competitive offers, with many closing well above list price. The formula remains consistent: accurate pricing informed by recent comps, a complete pre-listing disclosure package, professional staging, and a clean condition story. Aspirationally priced or homes with significant condition issues, by contrast, are sitting — even in Berkeley.

One emerging factor: Berkeley’s BESO (Building Emissions Saving Ordinance) requirements, effective January 1, 2026, are now part of buyer conversations. Sellers who have addressed compliance proactively are at an advantage. Visit my BESO Compliance Guide for details.

Guidance for Buyers and Sellers

For buyers: underwrite your purchase at today’s rate, and treat any future rate improvement as a bonus you’ll capture through a refinance. February and early March — before spring competition peaks — can offer more negotiating room. My Buyer Net Sheet and Mortgage Calculator can help you model real costs.

For sellers: the spring window is now open. If you’re thinking about listing, the time to prepare is now – inspection, staging, disclosures, and BESO compliance. Listings that hit the market in late February and March with everything in order consistently outperform those that don’t. My Seller Net Sheet and Opportunity Cost Calculator are useful starting points for the financial picture.

What I’m Watching

The January PPI releases February 27. The February jobs report is due March 6, CPI on March 11, and the Fed meets March 18-19. These will determine whether a June rate cut stays on the table and, by extension, whether mortgage rates stay near current levels or drift lower heading into peak selling season.

Berkeley’s spring market will tell us more than any of those reports. Based on what I’m seeing in buyer conversations right now, I expect a competitive season for well-positioned listings, particularly those in the $1.1 to $1.6 million range.

Focus Keyword: Berkeley Real Estate Market Trends Listings that hit the market in late February and March with everything in order consistently outperform those that don’t. My Seller Net Sheet and Opportunity Cost Calculator are useful starting points for the financial picture. The upcoming economic indicators, including the January PPI and February jobs report, will provide insights into market stability and potential mortgage rate movements. As we approach the peak selling season, the competitive landscape for well-positioned properties in Berkeley, especially those priced between $1.1 and $1.6 million, is expected to intensify.

If you’d like a personalized market analysis, a pre-listing consultation, or just want to talk through your options, I’d love to hear from you. Reach me at megan@meganmicco.com or (510) 708-9952, or schedule a conversation online.