As we move past the midpoint of the year, the relationship between national economic trends and the local real estate market is becoming increasingly important for both buyers and sellers. My August 2025 real estate market update begins with the most recent economic data—July’s inflation, employment, and wholesale price reports—then turns to the Federal Reserve’s latest policy signals, mortgage interest rate trends, and finally, what all of this means for the Berkeley housing market.

The Current Economic Landscape

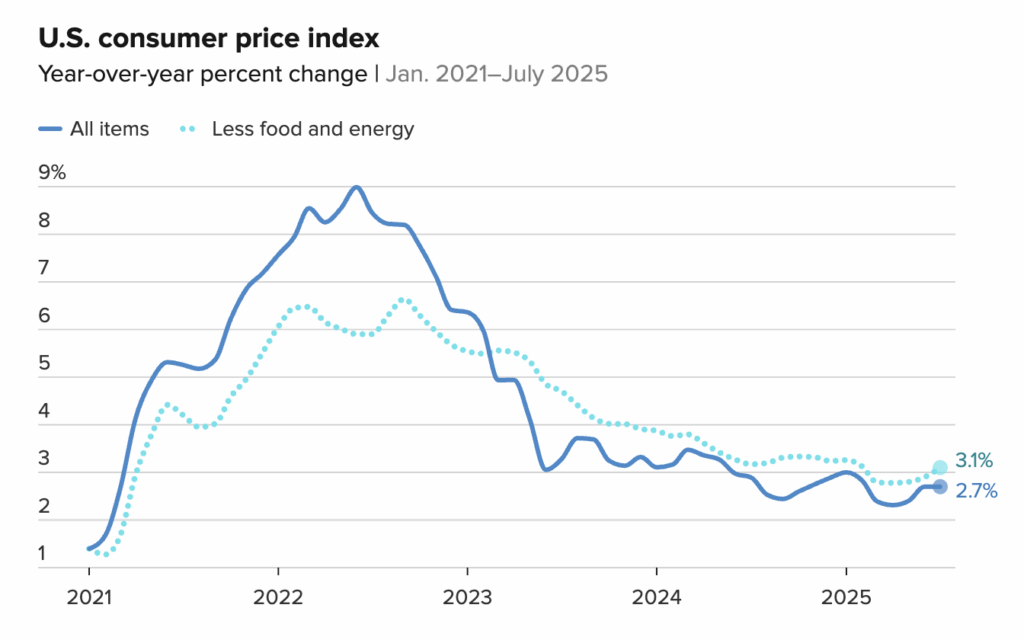

The latest Consumer Price Index (CPI) showed that prices in July rose 0.2 percent from the prior month and 2.7 percent compared with a year earlier. Core inflation, which excludes food and energy, increased 0.3 percent month-over-month and 3.1 percent year-over-year. Shelter costs, which make up a large share of the CPI basket, climbed another 0.2 percent, highlighting how persistent housing costs remain, while energy prices declined slightly.

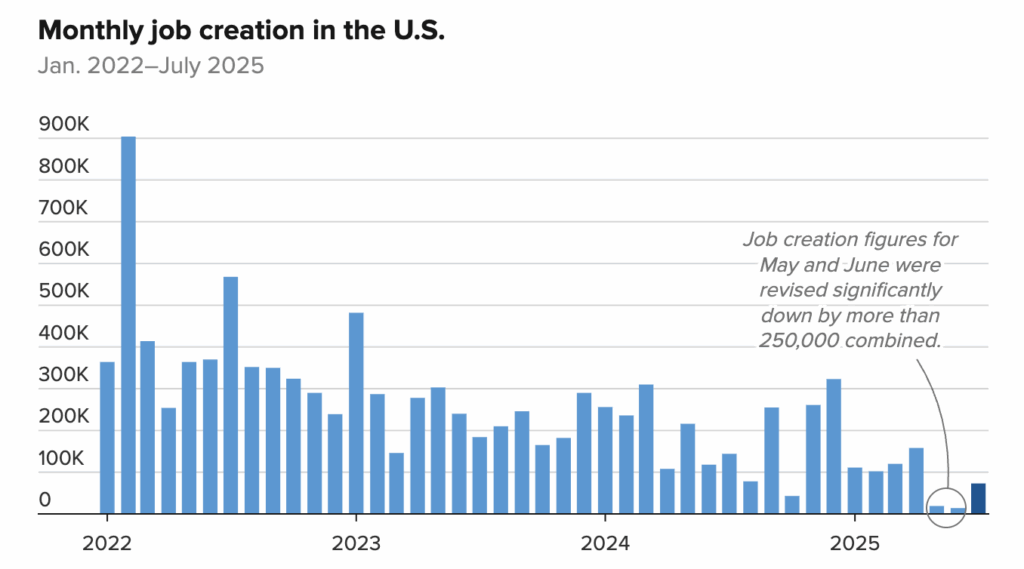

On the labor side, the July Employment Situation Report showed the U.S. added 73,000 jobs, well below the monthly averages of earlier this year. In addition, June and May totals were revised sharply lower, down by a combined 258,000 from previously announced levels. This revision was criticized by the presidential administration and eventually led to the firing of the commissioner of the Bureau of Labor Statistics (BLS). How the politicization of federal economic data is going to impact the economy moving forward is unknown, but historically global investors lose confidence in sovereign currencies and debt which can have undesirable outcomes.

On the up side, the unemployment rate held at 4.2 percent, and wages rose 0.3 percent from June and 3.9 percent over the past year. Hiring was strongest in healthcare and social assistance, while government payrolls declined. These numbers point to a labor market that is cooling but still fundamentally resilient.

The Producer Price Index (PPI), however, surprised on the upside. Wholesale prices jumped 0.9 percent in July and 3.3 percent over the past 12 months, the highest annual increase since February. Both goods and services costs rose, with food categories like vegetables and meats leading the way, alongside higher hospitality and equipment costs. This uptick complicates the picture of easing inflation and suggests the Federal Reserve still has work to do.

The Federal Reserve and Jackson Hole

Against this backdrop, the Federal Reserve held its annual Jackson Hole Economic Policy Symposium in late August. In his remarks, Chair Jerome Powell said the Fed “may need to cut rates” as the labor market continues to soften, but emphasized that policymakers will “proceed carefully.” Powell stressed that decisions remain data-dependent, with no preset course, underscoring the Fed’s balancing act between slowing job growth and still-elevated inflation.

Housing Market Impacts

Financial markets appeared to interpret Powell’s speech as slightly dovish, increasing the odds of a rate cut later this year if inflation and employment data continue to ease. Mortgage rates, which track 10-year Treasury yields, have already responded to this tone shift. According to Freddie Mac’s Primary Mortgage Market Survey, the average 30-year fixed mortgage fell to about 6.58 percent in mid-August, its lowest level since fall 2024. These lower borrowing costs have supported a modest rebound in housing activity nationwide.

The National Association of Realtors reported that existing-home sales rose 2.0 percent in July to an annualized pace of 4.01 million units, up slightly from a year earlier, with the median U.S. home price holding at $422,400 and inventory improving to 4.6 months of supply. In California, sales slowed by 1.0 percent from June and 4.1 percent year-over-year to a seasonally adjusted annualized rate of 261,820, while the median price dipped 1.7 percent month-over-month to $884,050, down 0.3 percent compared with last year.

Berkeley and the Inner East Bay

So what does this mean for Berkeley? July’s data shows that the city continues to reflect national trends while retaining its own idiosyncratic dynamics. The median Berkeley home sold for about $1.375 million, down roughly 2 percent from the same time last year. Homes spent a median of 20 days on the market, and there were 59 closed transactions in July. Well-prepared and strategically priced homes continue to attract multiple offers, often selling well above list price. By contrast, aspirationally priced properties—even those in premium neighborhoods—are sitting longer and sometimes requiring price reductions.

On the ground, I’m seeing intense competition for turnkey homes in neighborhoods like Elmwood, North Berkeley, and Thousand Oaks. Pricing discipline remains critical—sellers who allow the latest comparable sales data to inform pricing decision are the ones generating bidding wars. Condition concerns remain a hurdle for many buyers that are looking for turnkey properties, particularly in a time of global tariffs and rising building material costs.

Evaluating Real Estate Opportunities

For buyers, today’s mortgage rates near 6.6 percent are more favorable than earlier in the year, and Powell’s Jackson Hole comments suggest there may be incremental relief ahead if inflation continues to cool. Still, the best strategy is to underwrite your purchase at current rates, pursue tools like temporary buydowns or seller credits, and treat any further rate improvements as a bonus rather than a guarantee. For sellers, the lesson is clear: preparation and pricing win. Homes in good condition, with professional staging, fresh paint and landscaping, and complete disclosure packages continue to command premium offers, even in a high-cost borrowing environment.

Looking Ahead

Looking ahead, if August’s inflation and jobs data confirm the trajectory of easing inflation and a softening labor market, the Fed will have cover to cut rates later this year. That could keep mortgage rates trending sideways to slightly lower into the fall, which would support buyer activity. In Berkeley, the dynamic is unlikely to change: well-prepared listings will remain fiercely competitive, while overpriced or unpolished properties will lag.

For anyone considering buying or selling in Berkeley, the key is to stay informed about the national data while leveraging local market expertise. I’m here to provide personalized guidance on how these economic and housing trends intersect with your specific goals and timing.