As we pass the midpoint of the year, understanding the interplay between national economic trends and the local real estate market is crucial for both buyers and sellers—especially in dynamic communities like Berkeley. My July 2025 real estate market update offers a comprehensive look at the latest inflation and employment data, Federal Reserve policy, and most importantly, what these indicators might mean for the Berkeley housing market in the weeks and months ahead.

National Economic Snapshot: Inflation, Jobs, and the Fed

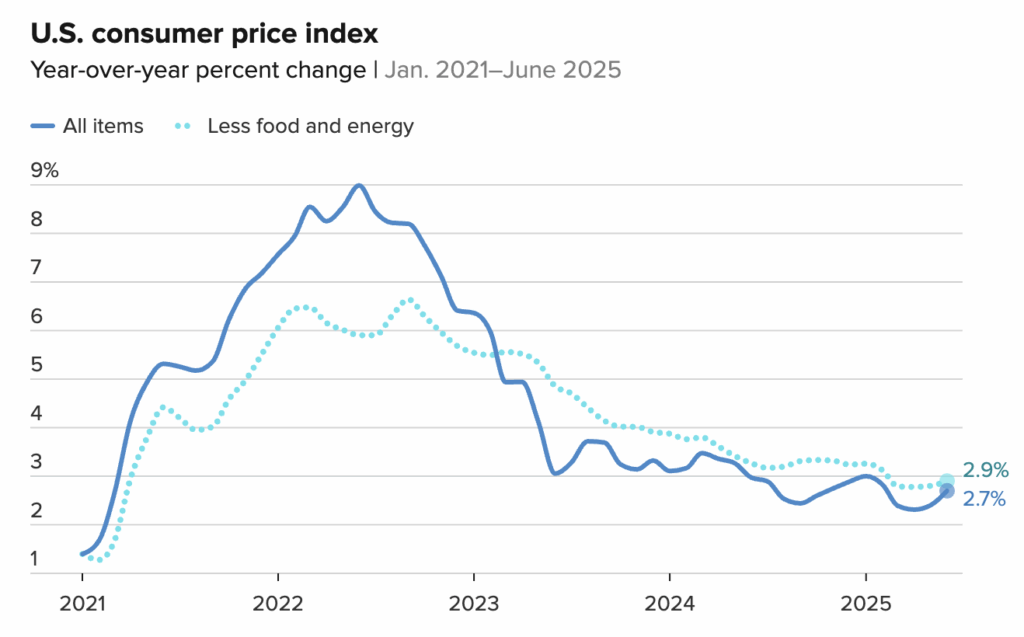

The U.S. economy continues to navigate a delicate balance between sustaining growth and taming inflation. As of June 2025, the Consumer Price Index (CPI) showed a 0.3% increase from the prior month, reflecting an annual inflation rate of 2.7%. This is a slight uptick compared to May’s 2.4% and highlights ongoing price pressures, particularly in the shelter segment, where costs rose 3.8% year-over-year. Food prices climbed 3.0%, whereas energy prices showed a mild decline of 0.8% over the last year. Core CPI, which excludes food and energy, edged up 0.2% in June and stands at 2.9% annually, signaling that inflation remains firm in underlying components, especially housing.

In June, producer prices were flat month-over-month following a 0.3% rise in May, as higher costs for goods were offset by a 0.1% decline in service prices. On a year-over-year basis, headline PPI rose 2.3%, the slowest annual gain since September 2024, while core PPI (excluding food and energy) ticked up around 2.5–2.6%. Tariff-driven increases in select goods—such as furniture and electronics—were partially offset by price drops in services categories like travel and lodging. Overall, June’s data suggest inflationary pressures remain moderate, though upcoming tariff hikes (effective August 1) could elevate goods prices in the months ahead.

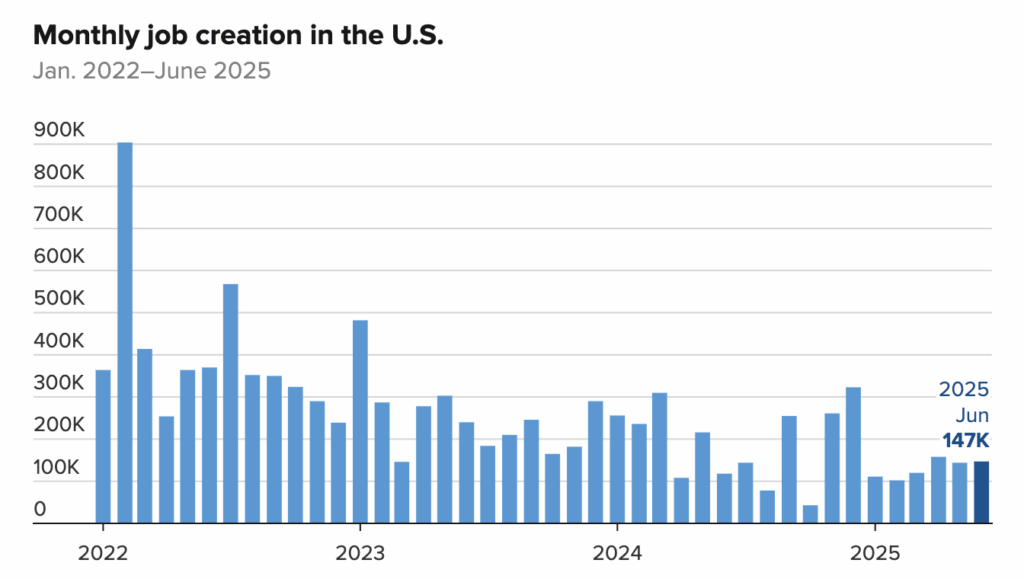

Finally, employment figures through May offer insight into the broader economic landscape. The U.S. economy added 139,000 jobs, signifying a labor market that’s steady but moderating. Wage growth has softened slightly to 3.9% year-over-year, which helps contain inflationary wage spirals but may constrain household purchasing power.

The Federal Reserve and the Presidential Administration

In response to these signals, the Federal Reserve has tempered expectations for aggressive interest rate cuts in the remainder of 2025. Mortgage interest rates, a critical factor for the housing market, have hovered near 6.2% recently, after falling to around 6.0% earlier in the year. The Fed’s caution on inflation and stable wage growth means mortgage rates are unlikely to see sharp reductions soon, maintaining pressure on housing affordability.

All that being said, recent speculation that President Trump may seek to fire Federal Reserve Chair Jerome Powell has introduced fresh uncertainty into financial markets—raising the prospect of higher interest rates across the board. While the Fed is designed to operate independently of political pressure, even the appearance of interference can erode investor confidence, leading to a selloff in U.S. Treasury bonds and a rise in yields. Because mortgage rates are closely tied to the 10-year Treasury, this kind of volatility tends to push borrowing costs higher for homebuyers.

In the short term, such news could cause a spike in mortgage rates as lenders price in added risk and inflation expectations. Over the long term, undermining the Fed’s credibility may entrench higher inflation and weaken the central bank’s ability to manage the economy effectively—both of which could contribute to persistently elevated mortgage rates.

What This Means for the Berkeley Real Estate Market

Berkeley’s real estate market mirrors this national economic environment, but its unique local characteristics add additional layers of nuance. As locals know, the city’s academic institutions, tech influence, and vibrant culture has historically shown resilience in housing demand.

Here’s how these macroeconomic factors are shaping the Berkeley market today:

- Moderate Inventory Growth but Continued Buyer Activity: Recent months have seen a mild increase in available homes for sale, easing some supply constraints. However, buyer interest remains firm, reflecting Berkeley’s desirability and the persistent need for housing near tech and academic job hubs.

According to the Bay East Association of Realtors, listings in Alameda County increased year-over-year, but remain below historical norms in the most desirable neighborhoods. - Upward Pricing Pressure from Shelter Inflation: The national housing inflation figure close to 3.8% is echoed locally, where rents and home prices continue to rise moderately. Despite elevated mortgage rates, the shelter cost factor keeps overall housing expenses climbing, which tempers affordability but also supports price stability. Zillow reports a slight month-over-month increase in median list prices for Berkeley homes as of July 2025.

- Labor Market Influence: Berkeley’s job market, shaped heavily by technology and education sectors, is somewhat insulated from the broader economic softening seen elsewhere. The continued adoption of AI and tech innovation fuels demand for skilled workers, maintaining a baseline of buying power and housing demand.

- Buyer and Seller Behavior: Many buyers in Berkeley are approaching the market with caution, wary of elevated borrowing costs but motivated by necessity. Sellers, meanwhile, remain selective, often reluctant to relinquish their lower-rate mortgages, which is keeping for-sale inventory from expanding rapidly.

Practical Takeaways for Buyers and Sellers

If you’re considering buying or selling in Berkeley right now, here are some essential points to keep in mind:

- Buyers: Prepare for competitive conditions, especially for homes priced right within desirable neighborhoods. Fixed mortgage rates hovering over 6% mean financing costs are higher than in recent years, so budget accordingly and consider locking in rates early if given the opportunity. While rates may soften slowly, don’t expect rapid drops. Keep an eye on your personal financial situation and explore possibilities to refinance later if the market improves.

- Sellers: Price your home realistically to attract serious buyers. While demand is steady, buyers are price-sensitive because of borrowing costs. Balancing optimism with market realities will help your property move efficiently without lingering. Also, turn-key properties are selling faster and for more money than those that need work, so consider critical upgrades to your home before going to sell.

- Monitor Macroeconomic Indicators: Stay informed about upcoming inflation and employment reports. Any unexpected shifts can influence the Federal Reserve’s policy decisions and, in turn, mortgage rates. This may impact housing demand and pricing locally.

- Leverage Local Market Expertise: Berkeley’s market nuances—from neighborhood desirability to employment trends—require professional guidance to navigate effectively. Working with an exceptional agent can help you seize opportunities and avoid pitfalls in this evolving landscape.

Looking Ahead

The sustained inflation in shelter costs, steady but moderate job growth, and the Fed’s cautious stance on rate cuts create a complex backdrop for the Berkeley housing market. While affordability challenges persist, the city’s strong economic fundamentals and limited supply underpin a resilient housing environment.

This situation rewards buyers and sellers who approach the market strategically—balancing timing, pricing, and financing considerations carefully. As the year progresses, gradual improvements in mortgage rates may emerge, but without dramatic shifts. Continual monitoring of economic trends will be key, and local market knowledge remains indispensable.

For anyone interested in Berkeley real estate, staying connected to these national and local insights can help you make smarter, more confident decisions in what remains one of the Bay Area’s most dynamic markets.

If you’re considering buying or selling in Berkeley or just want to understand what these economic forces mean for you, please reach out. I’m here to provide personalized insights tailored to your goals in today’s real estate market.